Consolidating debt can help manage your debt. You can also reduce the amount of your debt. It can also improve your payment history. You can even improve credit scores if this strategy is used correctly. Some lenders may even pay off your credit cards as part of the consolidation process. This will prevent you from being tempted not to use the cards for anything you don't actually need.

Costs

Debt consolidation can be expensive. It can give temporary financial relief. It does not always solve the root problem. The consolidation loan may lead to you getting into more debt than what you need. Before you sign any agreement with a debt consolidation company, compare the costs and benefits.

In most cases, the rates of interest that you'll have to pay once you've consolidated your debt can be higher than your original debt. Additionally, your credit score may be affected by the consolidation. To get the best rates, it's a good idea monitor your credit score before you sign up for any consolidation plan.

Fees

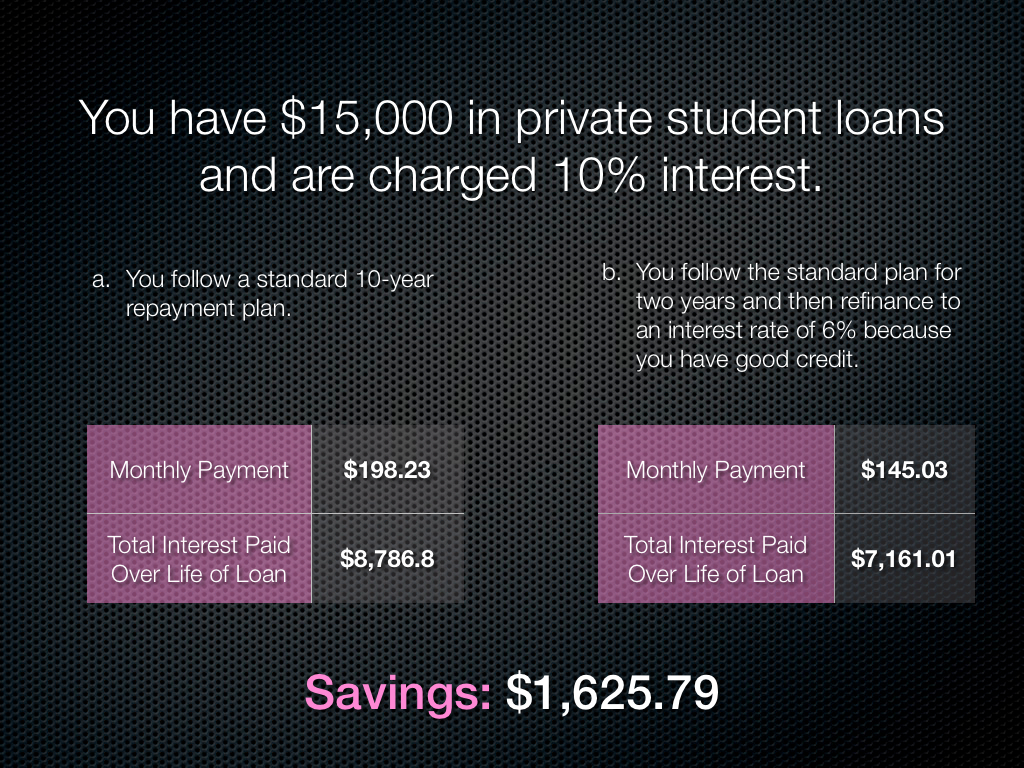

Consolidating debt helps consumers who have high amounts of debt make only one monthly payment, instead of several. It can lower monthly payments as well as interest rates. If you have good credit and can pay your debts off quickly, debt consolidation is the best option. A balance transfer or personal loan is a good option if you don’t have the funds to pay all your debts. You can save interest by having these programs make payments to your creditors.

Consolidating debt will help you improve your credit score and your payment history. Consolidating your debt may make it easier to pay the bills, but it is important to ensure that you aren't missing any. You can seriously damage your credit score if you miss any payments. There are many free tools to help improve your credit score. WalletHub, for example, provides a free credit score and daily progress tracking, as well as personalized advice on how to improve your score.

Impact on credit score

Consolidating your debt can have many benefits. It can also help you save money. It can also improve your credit score. FICO scores are determined by several factors. These include the length of time you've had credit, your payment history, and how much you owe. Your score will go up the longer you've been credit-worthy.

You may experience mixed effects from debt consolidation on your credit score. Some aspects of debt consolidation can have a negative impact on your credit score in the immediate, while others may improve it over time. How you manage your debt and your personal situation will impact the specific impact of debt consolidation.

There are other ways to consolidate your debt

A debt management program is another way to consolidate debt. This will not harm your credit score. A debt consolidation program is a great option to reduce monthly payments and better manage your finances. Before you decide on a debt consolidation plan, it is important to weigh the pros and cons. You might consider debt consolidation if your credit cards have high interest rates or you have to repay multiple loans in one monthly payment.

You can refinance multiple loans into one loan with a lender through debt consolidation loans. For this purpose, some consumers opt to use HELOCs (home equity loans) instead. However, the process is identical: you will need compare interest rates, repay your existing debts and make monthly repayments on your new loan.

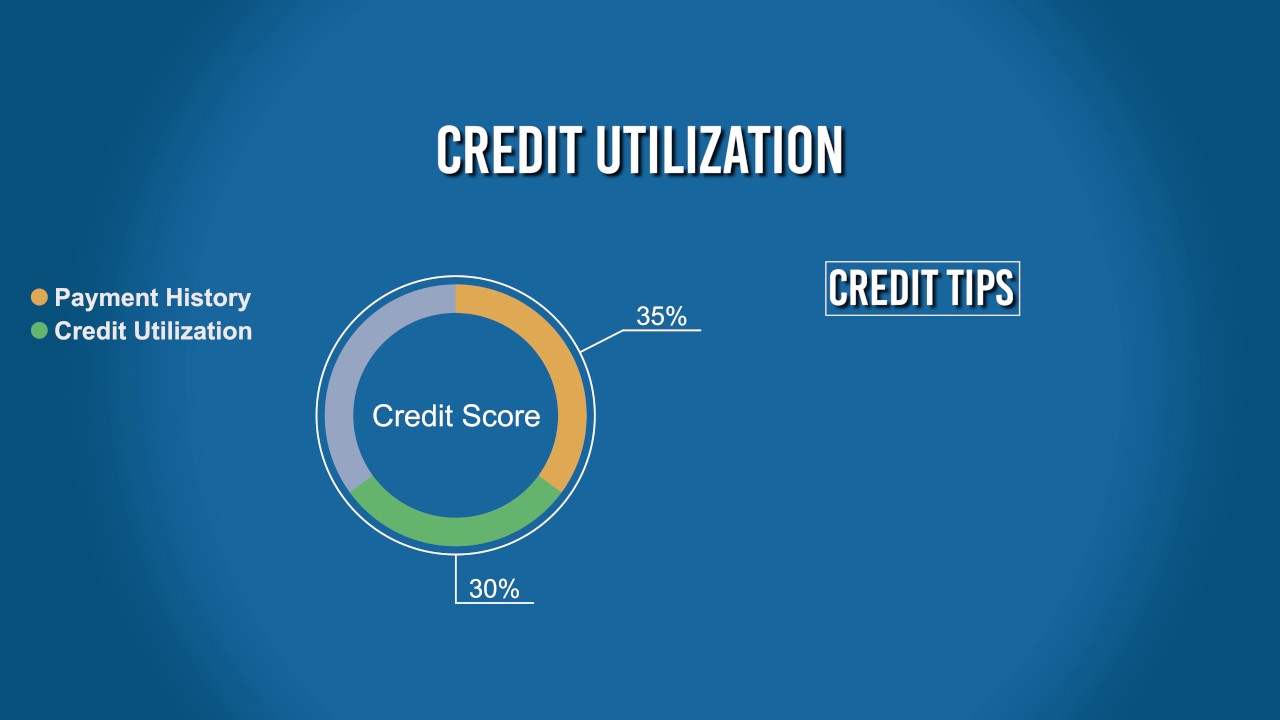

Credit utilization ratio has an impact

No matter whether you're considering debt consolidation, it's important to understand how high credit utilization affects your credit score. Your credit score is an important determinant of financial health. It can greatly impact your chances of getting a loan. Try to not use more than 30% of your credit available on revolving account. For the best results. Pay off all balances each and every month.

Consolidating your debt can reduce your credit utilization ratio, and make it easier to manage your debt. Although this can have a negative impact on your credit score, it is temporary. Your credit score can be improved by using it responsibly.

FAQ

How much debt can you take on?

It's essential to keep in mind that there is such a thing as too much money. You'll eventually run out cash if you spend more money than you earn. It takes time for savings growth to take place. So when you find yourself running low on funds, make sure you cut back on spending.

But how much is too much? There is no universal number. However, the rule of thumb is that you should live within 10%. This will ensure that you don't go bankrupt even after years of saving.

This means that even if you make $10,000 per year, you should not spend more then $1,000 each month. You shouldn't spend more that $2,000 monthly if your income is $20,000 You shouldn't spend more that $5,000 per month if your monthly income is $50,000

It is important to get rid of debts as soon as possible. This includes credit card bills, student loans, car payments, etc. After these debts are paid, you will have more money to save.

It is best to consider whether or not you wish to invest any excess income. If you choose to invest your money in bonds or stocks, you may lose it if the stock exchange falls. But if you choose to put it into a savings account, you can expect interest to compound over time.

For example, let's say you set aside $100 weekly for savings. This would add up over five years to $500. At the end of six years, you'd have $1,000 saved. In eight years, your savings would be close to $3,000 By the time you reach ten years, you'd have nearly $13,000 in savings.

Your savings account will be nearly $40,000 by the end 15 years. That's quite impressive. You would earn interest if the same amount had been invested in the stock exchange during the same period. Instead of $40,000 you would now have $57,000.

You need to be able to manage your finances well. If you don't, you could end up with much more money that you had planned.

What is the best passive income source?

There are tons of ways to make money online. Most of them take more time and effort than what you might expect. So how do you create an easy way for yourself to earn extra cash?

The answer is to find something you love, whether blogging, writing, designing, selling, marketing, etc. It is possible to make money from your passion.

For example, let's say you enjoy creating blog posts. Create a blog to share useful information on niche-related topics. When readers click on the links in those articles, they can sign up for your emails or follow you via social media.

This is known as affiliate marketing and you can find many resources to help get started. Here's a list with 101 tips and resources for affiliate marketing.

You might also think about starting a blog to earn passive income. This time, you'll need a topic to teach about. However, once your site is established, you can make it more profitable by offering ebooks, videos and courses.

There are many online ways to make money, but the easiest are often the best. Make sure you focus your efforts on creating useful websites and blogs if you truly want to make a living online.

Once you have created your website, share it on social media such as Facebook and Twitter. This is known as content marketing and it's a great way to drive traffic back to your site.

How to create a passive income stream

To consistently earn from one source, you need to understand why people buy what is purchased.

It is important to understand people's needs and wants. This requires you to be able connect with people and make sales to them.

The next step is to learn how to convert leads in to sales. To retain happy customers, you need to be able to provide excellent customer service.

Although you might not know it, every product and service has a customer. You can even design your entire business around that buyer if you know what they are.

To become a millionaire it takes a lot. A billionaire requires even more work. Why? You must first become a thousandaire in order to be a millionaire.

Finally, you can become a millionaire. And finally, you have to become a billionaire. The same is true for becoming billionaire.

How does one become billionaire? You must first be a millionaire. All you need to do to achieve this is to start making money.

You have to get going before you can start earning money. Let's look at how to get going.

What is the fastest way to make money on a side hustle?

You can't just create a product that solves someone's problem to make quick money if you want to really make it happen.

Also, you need to figure out a way that will position yourself as an authority on any niche you choose. This means that you need to build a reputation both online and offline.

The best way to build a reputation is to help others solve problems. So you need to ask yourself how you can contribute value to the community.

After answering that question, it's easy to identify the areas in which you are most qualified to work. There are many ways to make money online.

But when you look closely, you can see two main side hustles. The first involves selling products or services directly to customers. The second involves consulting services.

There are pros and cons to each approach. Selling products and services provides instant gratification because once you ship your product or deliver your service, you receive payment right away.

However, you may not achieve the level of success that you desire unless your time is spent building relationships with potential customers. These gigs can be very competitive.

Consulting allows you to grow and manage your business without the need to ship products or provide services. But, it takes longer to become an expert in your chosen field.

It is essential to know how to identify the right clientele in order to succeed in each of these options. This can take some trial and error. But, in the end, it pays big.

What is personal finances?

Personal finance is the art of managing your own finances to help you achieve your financial goals. This means understanding where your money goes and what you can afford. And, it also requires balancing the needs of your wants against your financial goals.

Learning these skills will make you financially independent. You won't need to rely on anyone else for your needs. You won't have to worry about paying rent, utilities or other bills each month.

Not only will it help you to get ahead, but also how to manage your money. It makes you happier overall. If you are happy with your finances, you will be less stressed and more likely to get promoted quickly.

Who cares about personal finances? Everyone does! Personal finance is the most popular topic on the Internet. Google Trends shows that searches for "personal finances" have increased by 1,600% in the past four years.

Today's smartphone users use their phones to compare prices, track budgets and build wealth. You can find blogs about investing here, as well as videos and podcasts about personal finance.

Bankrate.com says that Americans spend on the average of four hours per day watching TV and listening to music. They also spend time surfing the Web, reading books, or talking with their friends. That leaves only two hours a day to do everything else that matters.

Personal finance is something you can master.

Which side hustles are the most lucrative in 2022

The best way to make money today is to create value for someone else. You will make money if you do this well.

It may seem strange, but your creations of value have been going on since the day you were born. You sucked your mommy’s breast milk as a baby and she gave life to you. You made your life easier by learning to walk.

As long as you continue to give value to those around you, you'll keep making more. The truth is that the more you give, you will receive more.

Value creation is a powerful force that everyone uses every day without even knowing it. It doesn't matter if you're cooking dinner or driving your kids to school.

In reality, Earth has nearly 7 Billion people. Each person is creating an amazing amount of value every day. Even if your hourly value is $1, you could create $7 million annually.

This means that you would earn $700,000.000 more a year if you could find ten different ways to add $100 each week to someone's lives. Think about that - you would be earning far more than you currently do working full-time.

Now, let's say you wanted to double that number. Let's assume you discovered 20 ways to make $200 more per month for someone. You'd not only earn an additional $14.4 million annually but also be incredibly rich.

There are millions of opportunities to create value every single day. This includes selling products, services, ideas, and information.

Even though we spend much of our time focused on jobs, careers, and income streams, these are merely tools that help us accomplish our goals. Helping others to achieve their goals is the ultimate goal.

Focus on creating value if you want to be successful. Use my guide How to create value and get paid for it.

Statistics

- Mortgage rates hit 7.08%, Freddie Mac says Most Popular (marketwatch.com)

- As mortgage rates dip below 7%, ‘millennials should jump at a 6% mortgage like bears grabbing for honey' New homeowners and renters bear the brunt of October inflation — they're cutting back on eating out, entertainment and vacations to beat rising costs (marketwatch.com)

- Shares of Six Flags Entertainment Corp. dove 4.7% in premarket trading Thursday, after the theme park operator reported third-quarter profit and r... (marketwatch.com)

- U.S. stocks could rally another 25% now that Fed no longer has ‘back against the wall' in inflation fight (marketwatch.com)

- 4 in 5 Americans (80%) say they put off financial decisions, and 35% of those delaying those decisions say it's because they feel overwhelmed at the thought of them. (nerdwallet.com)

External Links

How To

You can increase cash flow by using passive income ideas

There are ways to make money online without having to do any hard work. Instead, passive income can be made from your home.

Automating your business could be a benefit to an already existing company. If you are thinking of starting a business, you might find that automating parts of your workflow can help you save time and increase productivity.

The more automated your company becomes, the more efficient you will see it become. This means you will be able to spend more time working on growing your business rather than running it.

Outsourcing tasks is an excellent way to automate them. Outsourcing lets you focus on the most important aspects of your business. You are effectively outsourcing a task and delegating it.

You can concentrate on the most important aspects of your business and let someone else handle the details. Outsourcing allows you to focus on the important aspects of your business and not worry about the little things.

A side hustle is another option. You can also use your talents to create an online product or service. This will help you generate additional cash flow.

If you like writing, why not create articles? You can publish articles on many sites. These websites offer a way to make extra money by publishing articles.

You can also consider creating videos. Many platforms allow you to upload videos to YouTube or Vimeo. You'll receive traffic to your website and social media pages when you post these videos.

Another way to make extra money is to invest your capital in shares and stocks. Stocks and shares are similar to real estate investments. Instead of receiving rent, dividends are earned.

They are included in your dividend when shares you buy are purchased. The amount you get depends on how many shares you purchase.

You can sell shares later and reinvest the profits into more shares. You will keep receiving dividends for as long as you live.