A certain interest rate (or APR) will be applied to purchases made with credit cards. The APR is applicable to all purchases and generally ranges from three to three-and-a-half percent per month. The APR may change from time-to-time, so make sure to verify it before you make any purchases.

Variable APR

Variable APR can make it difficult for you to manage your finances. But the good news is that your card's interest rates can be easily changed to one that's lower. Credit card companies don’t usually need to inform their cardholders about changes of variable APR. However you can request that they lower the rate if you have strong credit. If you pay your balance each month, you may be able to switch to a card at a lower rate.

Variable APR credit cards issuers have the right to change the interest rate of a credit line without prior notice. However, they must comply with the terms and conditions of the cardmember agreement. Fixed APR credit cards issuers must notify you in writing within 45 days before they change the interest rate. In addition, if you don't agree with the changes, you can always terminate the account and stop using your card.

APR introductory

When you open a new credit card account, you may be able to take advantage of an introductory APR. The introductory rate is usually lower than the regular rate and sometimes even as low as 0 percent. This rate applies to balance transfers as well as purchases. It is valid for 12 month. The regular rate will be in effect after that time. Cash advances have no grace period and are subject to the introductory rate.

You may need to pay a minimum amount each month or you may lose your introductory APR. You should also read the terms and conditions on your credit card to understand what the regular purchase rate is. It is best to pay off your balance before the introductory period ends to be eligible for an introductory purchase price APR.

Penalty APR

If you have a high APR on your credit card, you may want to consider making a balance transfer to another credit card. This option can help you to pay off your balance faster. Ask your credit card provider to lower your interest rate. Make sure you ask your caller how long it takes for the interest rate reduction to take effect.

Penalty APR will apply to interest rates if you are late on payments. The penalty APR is calculated on the balance of the card at the time you fall behind in payments. It also applies to any balances that you have afterward, until the credit card issuer returns to normal interest rates. A penalty APR applies to any balance that is more than six months old. If your payments have been made on time, you can ask the credit card issuer to lower your APR.

APR on cash advances

A cash advance on your credit card is an easy and quick solution to short-term financial problems. However, the APR and transaction fees can quickly add up and hurt your credit rating. There are steps that you can take to lower the cost and keep the interest rate low. First, only get what you need.

Check your account before you apply for a cash advance. Make sure to read the terms and conditions. Be sure to only borrow the amount you require and pay it back as soon possible. A personal loan is another option, which can usually be approved within days and can be used in many different ways.

Balance transfer APR

The APR charged on balance transfer credit cards varies depending on who issues them and what terms they offer. To give you an idea of what to watch out for, we've compared the major issuers and looked at the terms and conditions of several cards. It is important to consider the APR and minimum payment.

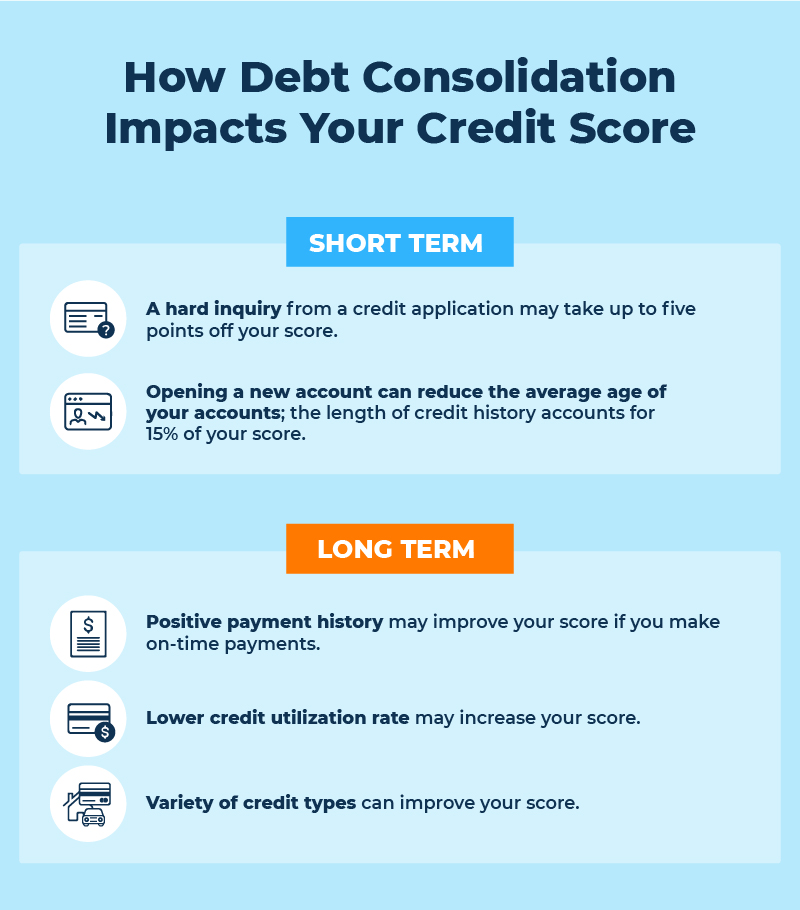

Before transferring balances, it is a good idea to review your credit score. It will go down a few points if you don't have a high score. Before you apply, check your credit report and score. Once you have done that, you can reach out to the new creditor for assistance. While credit cards are most commonly used to transfer debt, personal loans can also easily be transferred.

FAQ

What is personal finances?

Personal finance means managing your money to reach your goals at work and home. It involves understanding where your money goes, knowing what you can afford, and balancing your needs against your wants.

You can become financially independent by mastering these skills. That means you no longer have to depend on anyone for financial support. You don't need to worry about monthly rent and utility bills.

Learning how to manage your finances will not only help you succeed, but it will also make your life easier. It can make you happier. If you are happy with your finances, you will be less stressed and more likely to get promoted quickly.

Who cares about personal finance anyway? Everyone does! The most searched topic on the Internet is personal finance. Google Trends shows that searches for "personal finances" have increased by 1,600% in the past four years.

Today, people use their smartphones to track budgets, compare prices, and build wealth. They read blogs such this one, listen to podcasts about investing, and watch YouTube videos about personal financial planning.

Bankrate.com says that Americans spend on the average of four hours per day watching TV and listening to music. They also spend time surfing the Web, reading books, or talking with their friends. Only two hours are left each day to do the rest of what is important.

If you are able to master personal finance, you will be able make the most of it.

Why is personal financial planning important?

A key skill to any success is personal financial management. We live in a world with tight finances and must make tough decisions about how we spend our hard earned cash.

So why should we wait to save money? Is there nothing better to spend our time and energy on?

Both yes and no. Yes, as most people feel guilty about saving their money. Yes, but the more you make, the more you can invest.

If you can keep your eyes on what is bigger, you will always be able spend your money wisely.

Financial success requires you to manage your emotions. You won't be able to see the positive aspects of your situation and will have no support from others.

It is possible to have unrealistic expectations of how much you will accumulate. This could be because you don't know how your finances should be managed.

These skills will allow you to move on to the next step: learning how to budget.

Budgeting is the act of setting aside a portion of your income each month towards future expenses. Planning will save you money and help you pay for your bills.

Now that you are able to effectively allocate your resources, you can look forward to a brighter future.

How can rich people earn passive income?

There are two options for making money online. You can create amazing products and services that people love. This is called earning money.

A second option is to find a way of providing value to others without creating products. This is known as "passive income".

Let's imagine you own an App Company. Your job is developing apps. You decide to give away the apps instead of making them available to users. That's a great business model because now you don't depend on paying users. Instead, you can rely on advertising revenue.

To help you pay your bills while you build your business, you may also be able to charge customers monthly.

This is how the most successful internet entrepreneurs make money today. They are more focused on providing value than creating stuff.

What is the easiest passive source of income?

There are tons of ways to make money online. However, most of these require more effort and time than you might think. How do you find a way to earn more money?

The solution is to find what you enjoy, blogging, writing or selling. You can then monetize your passion.

For example, let's say you enjoy creating blog posts. You can start a blog that shares useful information about topics in your niche. Then, when readers click on links within those articles, sign them up for emails or follow you on social media sites.

This is called affiliate marketing, and there are plenty of resources to help you get started. Here's a list with 101 tips and resources for affiliate marketing.

You might also think about starting a blog to earn passive income. Once again, you'll need to find a topic you enjoy teaching about. Once you have established your website, you can make it a monetizable resource by selling ebooks, courses, and videos.

While there are many options for making money online, the most effective ones are the easiest. If you really want to make money online, focus on building websites or blogs that provide useful information.

After you have built your website, make sure to promote it on social media platforms like Facebook, Twitter and LinkedIn. This is content marketing. It's an excellent way to bring traffic back to your website.

What side hustles are the most profitable?

Side hustles can be described as any extra income stream that supplements your main source of income.

Side hustles are important because they make it possible to earn extra money for fun activities as well as bills.

Side hustles are a way to make more money, save time, and increase your earning power.

There are two types. Online businesses like e-commerce, blogging, and freelance work are all passive side hustles. Some of the active side hustles are tutoring, dog walking and selling eBay items.

Side hustles that are right for you fit in your daily life. Start a fitness company if you are passionate about working out. You may be interested in becoming a freelance landscaper if your passion is spending time outdoors.

You can find side hustles anywhere. Look for opportunities where you already spend time -- whether it's volunteering or taking classes.

If you are an expert in graphic design, why don't you open your own graphic design business? Perhaps you are a skilled writer, why not open your own graphic design studio?

Be sure to research thoroughly before you start any side hustle. This way, when the opportunity arises, you'll be ready to jump right in and take advantage of it.

Side hustles can't be just about making a living. They are about creating wealth, and freedom.

There are so many ways to make money these days, it's hard to not start one.

How can a beginner earn passive income?

Begin with the basics. Next, learn how you can create value for yourself and then look at ways to make money.

You may even have a few ideas already. If you do, great! You're great!

Find a job that suits your skills and interests to make money online.

If you are passionate about creating apps and websites, you can find many opportunities to generate revenue while you're sleeping.

But if you're more interested in writing, you might enjoy reviewing products. Or if you're creative, you might consider designing logos or artwork for clients.

Whatever topic you choose to focus on, ensure that it's something you enjoy. That way, you'll stick with it long-term.

Once you have discovered a product or service that you are passionate about helping others purchase, you need to figure how to market it.

There are two main ways to go about this. One is to charge a flat rate for your services (like a freelancer), and the second is to charge per project (like an agency).

In each case, once your rates have been set, you will need to promote them. This can be done via social media, emailing, flyers, or posting them to your list.

Keep these three tips in your mind as you promote your business to increase your chances of success.

-

e professional - always act like a professional when doing anything related to marketing. It is impossible to predict who might be reading your content.

-

Know your subject matter before you speak. After all, no one likes a fake expert.

-

Avoid spamming - unless someone specifically requests information, don't email everyone in your contact list. You can send a recommendation to someone who has asked for it.

-

Use an email service provider that is reliable and free - Yahoo Mail and Gmail both offer easy and free access.

-

Monitor your results - track how many people open your messages, click links, and sign up for your mailing lists.

-

Measuring your ROI is a way to determine which campaigns have the highest conversions.

-

Ask for feedback: Get feedback from friends and family about your services.

-

Try different strategies - you may find that some work better than others.

-

Learn new things - Keep learning to be a marketer.

Statistics

- These websites say they will pay you up to 92% of the card's value. (nerdwallet.com)

- Mortgage rates hit 7.08%, Freddie Mac says Most Popular (marketwatch.com)

- As mortgage rates dip below 7%, ‘millennials should jump at a 6% mortgage like bears grabbing for honey' New homeowners and renters bear the brunt of October inflation — they're cutting back on eating out, entertainment and vacations to beat rising costs (marketwatch.com)

- U.S. stocks could rally another 25% now that Fed no longer has ‘back against the wall' in inflation fight (marketwatch.com)

- According to the company's website, people often earn $25 to $45 daily. (nerdwallet.com)

External Links

How To

Passive Income Ideas To Improve Cash Flow

There are ways to make money online without having to do any hard work. Instead, there are passive income options that you can use from home.

Perhaps you have an existing business which could benefit from automation. If you are thinking of starting a business, you might find that automating parts of your workflow can help you save time and increase productivity.

Your business will become more efficient the more it is automated. This allows you to spend more time growing your business than managing it.

Outsourcing tasks can be a great way to automate them. Outsourcing allows your business to be more focused on what is important. Outsourcing a task is effectively delegating it.

This allows you to focus on the essential aspects of your business, while having someone else take care of the details. Outsourcing helps you grow your business by removing the need to manage the small details.

Turn your hobby into a side-business. You can also use your talents to create an online product or service. This will help you generate additional cash flow.

Articles are an example of this. You can publish articles on many sites. These sites pay per article and allow you to make extra cash monthly.

It is possible to create videos. Many platforms let you upload videos directly to YouTube and Vimeo. These videos will bring traffic to your site and social media pages.

Stocks and shares are another way to make some money. Investing in shares and stocks is similar to investing real estate. You are instead paid rent. Instead, you receive dividends.

As part of your payout, shares you have purchased are given to shareholders. The amount of dividend you receive depends on the stock you have.

If your shares are sold later, you can reinvest any profits back into purchasing more shares. This will ensure that you continue to receive dividends.