Debt consolidation refers to the process by which multiple loans are paid off with one loan. Although it is usually used to describe an individual's financial plan, the term could also refer a country’s fiscal approach to consolidating their debt. Debt consolidation has several benefits. They offer lower interest rates and lower monthly payment.

Reduced interest

Consolidating debt can help you pay down your debt quicker. The reason is that a lower rate of interest means that more money goes to paying off debt, and less towards interest. This will make it easier to save money and use the extra money to achieve other personal goals. This money can be used for emergency savings or purchases for your loved ones. The amount of money you can save by consolidating your debt will depend on the type of debt you have and your credit score.

Monthly payments are lower

If you have multiple credit cards and loans with high interest rate debt consolidation is an option. This option allows you to manage multiple monthly payments and reduce interest costs. There are some downsides to this option. However, debt consolidation doesn't eliminate your debt. Also, it doesn't address your behavior that contributed to your debt. This option might not work for you if you have problems with excessive spending.

Lenders are less at risk

There are some things you need to know about loans that consolidate all your debt. This type of loan is often more expensive than debt consolidation with a credit card, and your credit score will be impacted by the added loan. A high credit score can qualify you for lower interest rates. This will save you money in the long run. It is important to consider your ability to pay the monthly debt consolidation payment. Don't consolidate debt if it is impossible to repay your loan on-time.

Credit score impact

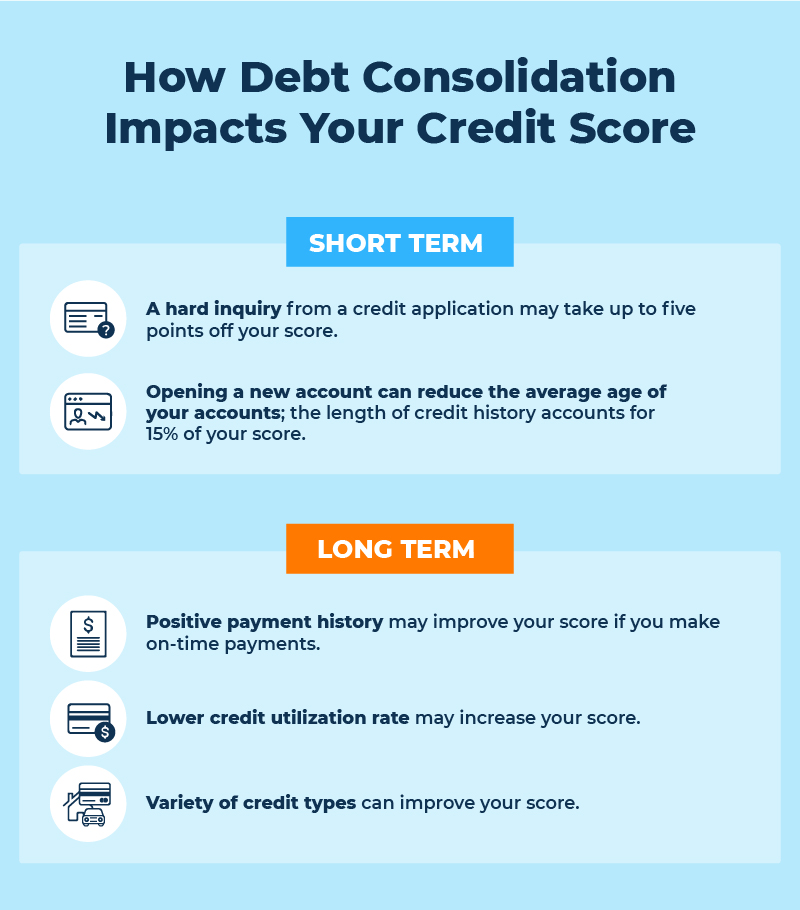

Consolidating your debt can have both a good and bad impact on credit scores. You can offset the negative impact of debt consolidation by opening new lines of credit or loans to pay off older ones. You can reduce this effect by closing old credit cards and paying off high interest rate debts. Taking on more debt than you can afford will also hurt your score.

It is a good idea to have good credit.

Debt consolidation involves taking out one loan to pay off multiple loans. This will often involve a personal loan or balance transfer card. Depending on which type of consolidation is used, it can have a favorable or negative effect on credit score. A new account opening will affect the average age and make it more difficult for you to build your credit history. Keeping all existing accounts open can improve your credit score.

Drawbacks

Although debt consolidation offers many benefits, there are also some downsides. It does not guarantee you won't get into debt again. People who have been in debt before will likely continue to live beyond their means once they consolidate their debt. This is why it is important to have a realistic budget. Also, save money for unanticipated expenses. Second, identify and fix the bad spending habits that are leading you to debt.

FAQ

What side hustles will be the most profitable in 2022

The best way today to make money is to create value in the lives of others. This will bring you the most money if done well.

Although you may not be aware of it, you have been creating value from day one. When you were a baby, you sucked your mommy's breast milk and she gave you life. Your life will be better if you learn to walk.

You will always make more if your efforts are to be a positive influence on those around you. In fact, the more value you give, then the more you will get.

Value creation is a powerful force that everyone uses every day without even knowing it. It doesn't matter if you're cooking dinner or driving your kids to school.

There are actually nearly 7 billion people living on Earth today. This means that every person creates a tremendous amount of value each day. Even if you created $1 worth of value an hour, that's $7 million a year.

You could add $100 per week to someone's daily life if you found ten more. That would make you an additional $700,000 annually. Imagine that you'd be earning more than you do now working full time.

Let's say that you wanted double that amount. Let's say you found 20 ways to add $200 to someone's life per month. You would not only be able to make $14.4 million more annually, but also you'd become very wealthy.

Every day offers millions of opportunities to add value. This includes selling information, products and services.

Although we tend to spend a lot of time focusing on our careers and income streams, they are just tools that allow us to achieve our goals. Helping others to achieve their goals is the ultimate goal.

Create value to make it easier for yourself and others. You can get my free guide, "How to Create Value and Get Paid" here.

What's the best way to make fast money from a side-hustle?

If you really want to make money fast, you'll have to do more than create a product or service that solves a problem for someone.

Also, you need to figure out a way that will position yourself as an authority on any niche you choose. It is important to establish a good reputation online as well offline.

Helping people solve problems is the best way build a reputation. It is important to consider how you can help the community.

Once you answer that question you'll be able instantly to pinpoint the areas you're most suitable to address. There are many online ways to make money, but they are often very competitive.

However, if you look closely you'll see two major side hustles. The one involves selling direct products and services to customers. While the other involves providing consulting services.

Each approach has its pros and cons. Selling services and products provides immediate gratification as you receive payment immediately after shipping your product or delivering your service.

On the flip side, you might not reach the level of success you desire unless you spend time developing relationships with potential clients. These gigs are also highly competitive.

Consulting can help you grow your business without having to worry about shipping products and providing services. But, it takes longer to become an expert in your chosen field.

If you want to succeed at any of the options, you have to learn how identify the right clients. This can take some trial and error. It pays off in the end.

What is the difference between passive and active income?

Passive income is when you make money without having to do any work. Active income requires hardwork and effort.

If you are able to create value for somebody else, then that's called active income. If you provide a service or product that someone is interested in, you can earn money. This could include selling products online or creating ebooks.

Passive income allows you to be more productive while making money. Most people don't want to work for themselves. People choose to work for passive income, and so they invest their time and effort.

Passive income isn't sustainable forever. If you are not quick enough to start generating passive income you could run out.

You also run the risk of burning out if you spend too much time trying to generate passive income. It is best to get started right away. If you wait to start earning passive income, you might miss out opportunities to maximize the potential of your earnings.

There are three types passive income streams.

-

There are several options available for business owners: you can start a company, buy a franchise and become a freelancer. Or rent out your property.

-

Investments - These include stocks, bonds and mutual funds as well ETFs.

-

Real Estate includes flipping houses, purchasing land and renting properties.

What is the limit of debt?

It is important to remember that too much money can be dangerous. You'll eventually run out cash if you spend more money than you earn. It takes time for savings growth to take place. So when you find yourself running low on funds, make sure you cut back on spending.

But how much can you afford? Although there's no exact number that will work for everyone, it is a good rule to aim to live within 10%. You'll never go broke, even after years and years of saving.

If you earn $10,000 per year, this means you should not spend more than $1,000 per month. If you make $20,000, you should' t spend more than $2,000 per month. For $50,000 you can spend no more than $5,000 each month.

It's important to pay off any debts as soon and as quickly as you can. This includes student loans and credit card bills. Once these are paid off, you'll still have some money left to save.

It's best to think about whether you are going to invest any of the surplus income. You may lose your money if the stock markets fall. However, if you put your money into a savings account you can expect to see interest compound over time.

Let's take, for example, $100 per week that you have set aside to save. It would add up towards $500 over five-years. After six years, you would have $1,000 saved. In eight years, you'd have nearly $3,000 in the bank. It would take you close to $13,000 to save by the time that you reach ten.

In fifteen years you will have $40,000 saved in your savings. Now that's quite impressive. You would earn interest if the same amount had been invested in the stock exchange during the same period. Instead of $40,000 in savings, you would have more than 57,000.

This is why it is so important to understand how to properly manage your finances. You might end up with more money than you expected.

What is the best passive income source?

There are many ways to make money online. Most of them take more time and effort than what you might expect. How can you make extra cash easily?

Finding something you love is the key to success, be it writing, selling, marketing or designing. Find a way to monetize this passion.

For example, let's say you enjoy creating blog posts. Create a blog to share useful information on niche-related topics. You can then sign up your readers for email or social media by inviting them to click on the links contained in your articles.

This is called affiliate marketing, and there are plenty of resources to help you get started. Here's a collection of 101 affiliate marketing tips & resources.

As another source of passive income, you might also consider starting your own blog. Again, you will need to find a topic which you love teaching. After you've created your website, you can start offering ebooks and courses to make money.

There are many online ways to make money, but the easiest are often the best. You can make money online by building websites and blogs that offer useful information.

Once your website is built, you can promote it via social media sites such as Facebook, Twitter, LinkedIn and Pinterest. This is what's known as content marketing. It's a great way for you to drive traffic back your site.

Why is personal finance so important?

Personal financial management is an essential skill for anyone who wants to succeed. In a world of tight money, we are often faced with difficult decisions about how much to spend.

Why should we save money when there are better things? Is there something better to invest our time and effort on?

Yes, and no. Yes, as most people feel guilty about saving their money. Because the more money you earn the greater the opportunities to invest.

You'll always be able justify spending your money wisely if you keep your eyes on the bigger picture.

It is important to learn how to control your emotions if you want to become financially successful. You won't be able to see the positive aspects of your situation and will have no support from others.

Your expectations regarding how much money you'll eventually accumulate may be unrealistic. This could be because you don't know how your finances should be managed.

These skills will prepare you for the next step: budgeting.

Budgeting is the act of setting aside a portion of your income each month towards future expenses. By planning, you can avoid making unnecessary purchases and ensure that you have sufficient funds to cover your bills.

So now that you know how to allocate your resources effectively, you can begin to look forward to a brighter financial future.

Statistics

- Etsy boasted about 96 million active buyers and grossed over $13.5 billion in merchandise sales in 2021, according to data from Statista. (nerdwallet.com)

- Mortgage rates hit 7.08%, Freddie Mac says Most Popular (marketwatch.com)

- Shares of Six Flags Entertainment Corp. dove 4.7% in premarket trading Thursday, after the theme park operator reported third-quarter profit and r... (marketwatch.com)

- While 39% of Americans say they feel anxious when making financial decisions, according to the survey, 30% feel confident and 17% excited, suggesting it is possible to feel good when navigating your finances. (nerdwallet.com)

- According to a June 2022 NerdWallet survey conducted online by The Harris Poll. (nerdwallet.com)

External Links

How To

How to Make Money Online Without Any Experience

There are many ways to make money online. While some people like to use computers for work, others prefer to be outside and interact with others.

There is always room to improve, no matter who you are. We will be looking at simple ways you can improve your life.

Since its inception, blogging has seen a tremendous growth. Nowadays, anyone who owns a computer can start a blog and earn money from it.

A blog is not only free, but it's very easy to set up too. Even if you don’t know much about blogging, all you need is a domain and a hosting provider.

Selling photos online can be one of the most lucrative ways to make an online income. It doesn't matter whether you're good with a camera or not.

It takes only a good quality digital camera, and a decent image editor application like Adobe Photoshop Elements. Once you've got those things, you can upload your images to sites like Fotolia where millions of people visit daily for high-quality photos to download.

Sell your skills if they are relevant to you. You can sell your skills online, regardless of whether you are a skilled writer or fluent in multiple languages.

Elance is a site that links freelancers with businesses seeking their services. Freelancers are asked to bid on projects that they have. The project is awarded to the highest bidder.

-

Create an Ebook and Sell it On Amazon

Amazon is one of the largest e-commerce sites on the Internet today. They offer a marketplace where people can buy and sell items.

You can also make an ebook and sell it through Amazon. This is a great option as you get paid per sale, not per page.

Another way to make extra money is to teach abroad. Teachers Pay Teachers allows you to connect with teachers who are looking for English lessons.

Any subject can be taught, including history, geography and art.

-

Google Write Adsense Articles is Another free way to advertise your website. When someone visits your website, you place small advertisements throughout the pages of the website. These ads are displayed whenever visitors view any given webpage.

You will earn more revenue the more traffic you get.

Digital selling is also possible. You can also sell your artwork digitally through sites such as Etsy.

Etsy lets users create virtual shops that look and act like real stores.

College graduates are increasingly interested in freelancing. As the economy improves, more companies outsource jobs for independent contractors.

It's a win-win situation for both employers and employees. Employers save money since they no longer have to pay benefits or payroll taxes. Employees can have more flexibility with their work schedules, while still earning an additional income.