Large lump sum payments are common for debt collectors to be able to negotiate. If you can pay more than the minimum amount, they will often accept your offer and give you a discount for doing so. It's important to get a written agreement for your debt collection negotiations. Also, it's important not to use abusive and foul language.

Avoiding bogus debt collectors

When negotiating with a debt collector, it is important to avoid being taken advantage of. It is important to confirm the identity of any debt collector. Legitimate debt collectors will provide their name, phone number, and address. You should be suspicious of any debt collector asking for personal information such as account numbers. Fraudsters could use this information to steal you identity.

Next, you need to identify what debt is being collected. This is vital because many debt collectors could be seeking bogus accounts, such as ones that have been paid. Avoid debt collectors that threaten to garnish your wages or put you in jail. Although these threats are not legal, they can be annoying.

Avoiding abusive or foul language from debt collectors

If you're trying to negotiate with a debt collector, you should avoid using abusive or foul language. Harassing a debtor with abusive or offensive language is illegal. Additionally, debt collectors are not allowed to repeatedly call or make abusive statements. These actions can be used against you in a later lawsuit.

When you are negotiating with a debt collector make sure that you fully understand your legal rights. Abuse is illegal and can result in a lawsuit. In most cases, the deadline to file suit is one-year from the date that the violation occurred. It is essential to provide all information necessary when dealing with debt collectors.

Let us know if you need any help.

There are many ways you can respond to debt collectors. A phone conversation is the best option, but it's also possible for you to write a letter to the representative stating your agreement. You must send the letter using certified mail to establish delivery. You can customize the format and length of the sample letter depending on your particular circumstances.

When composing the letter, it is important to include the name of the debtor, the amount owed, and the deadline for payment. Instructions on how to pay the debt should be included in the letter. If you're unable to pay the debt within five days, the debt collector is legally required to send you a validation letter. This letter contains the same information that the initial contact but must include more details.

Limit your offer to one lump-sum payment

If you're considering negotiating with a debt collector to settle a debt, limiting your offer to a lump-sum payment is a smart move. As with all negotiations, a debt collector could try to get you to pay more than your budget allows. Don't fall for the trap. There are many ways you can get out of debt. Limiting your offer to a lump sum payment is one option.

First, it's important to understand that the negotiation process with debt collectors is not the same for every agency. For example, some collection agencies may settle for half the amount while others insist that they receive the full amount. Keep in mind that the collection agency doesn't want to waste resources on a stalemate.

FAQ

Which passive income is easiest?

There are many options for making money online. But most of them require more time and effort than you might have. So how do you create an easy way for yourself to earn extra cash?

Finding something you love is the key to success, be it writing, selling, marketing or designing. You can then monetize your passion.

For example, let's say you enjoy creating blog posts. Your blog will provide useful information on topics relevant to your niche. You can sign readers up for emails and social media by clicking on the links in the articles.

This is affiliate marketing. There are lots of resources that will help you get started. Here's a collection of 101 affiliate marketing tips & resources.

A blog could be another way to make passive income. Again, you will need to find a topic which you love teaching. However, once your site is established, you can make it more profitable by offering ebooks, videos and courses.

Although there are many ways to make money online you can choose the easiest. You can make money online by building websites and blogs that offer useful information.

Once you've built your website, promote it through social media sites like Facebook, Twitter, LinkedIn, Pinterest, Instagram, YouTube and more. This is what's known as content marketing. It's a great way for you to drive traffic back your site.

What is the difference between passive and active income?

Passive income means that you can make money with little effort. Active income is earned through hard work and effort.

Active income is when you create value for someone else. You earn money when you offer a product or service that someone needs. This could include selling products online or creating ebooks.

Passive income is great because it allows you to focus on more important things while still making money. However, most people don't like working for themselves. People choose to work for passive income, and so they invest their time and effort.

The problem is that passive income doesn't last forever. If you are not quick enough to start generating passive income you could run out.

It is possible to burn out if your passive income efforts are too intense. Start now. You will miss opportunities to maximize your earnings potential if you put off building passive income.

There are three types to passive income streams.

-

There are several options available for business owners: you can start a company, buy a franchise and become a freelancer. Or rent out your property.

-

Investments include stocks, bonds, mutual funds, ETFs, and ETFs.

-

Real Estate: This covers buying land, renting out properties, flipping houses and investing into commercial real estate.

What are the top side hustles that will make you money in 2022

You can make money by creating value for someone else. If you do it well, the money will follow.

Even though you may not realise it right now, you have been creating value since the beginning. As a baby, your mother gave you life. Learning to walk gave you a better life.

You'll continue to make more if you give back to the people around you. The truth is that the more you give, you will receive more.

Value creation is a powerful force that everyone uses every day without even knowing it. You're creating value all day long, whether you're making dinner for your family or taking your children to school.

There are actually nearly 7 billion people living on Earth today. That means that each person is creating a staggering amount of value daily. Even if your hourly value is $1, you could create $7 million annually.

You could add $100 per week to someone's daily life if you found ten more. That would make you an additional $700,000 annually. Imagine that you'd be earning more than you do now working full time.

Let's say that you wanted double that amount. Let's suppose you find 20 ways to increase $200 each month in someone's life. Not only would you make an additional $14.4million dollars per year, but you'd also become extremely wealthy.

Every single day, there are millions more opportunities to create value. This includes selling products, ideas, services, and information.

Although many of us spend our time thinking about careers and income streams, these tools are only tools that enable us to reach our goals. The real goal is to help other people achieve their goals.

Create value to make it easier for yourself and others. My free guide, How To Create Value and Get Paid For It, will help you get started.

How much debt is considered excessive?

It's essential to keep in mind that there is such a thing as too much money. If you spend more than you earn, you'll eventually run out of cash because it takes time for savings to grow. If you are running out of funds, cut back on your spending.

But how much is too much? There isn't an exact number that applies to everyone, but the general rule is that you should aim to live within 10% of your income. You'll never go broke, even after years and years of saving.

This means that even if you make $10,000 per year, you should not spend more then $1,000 each month. You shouldn't spend more that $2,000 monthly if your income is $20,000 If you earn $50,000, you should not spend more than $5,000 per calendar month.

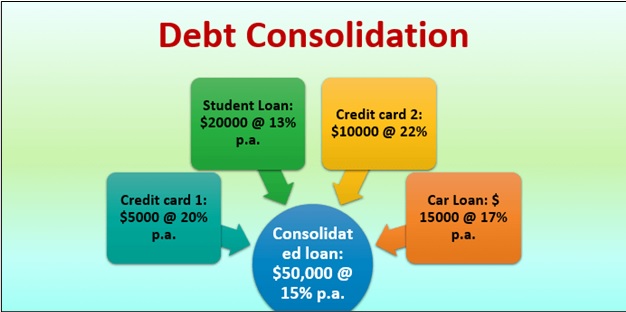

Paying off your debts quickly is the key. This includes student loans, credit cards, car payments, and student loans. When these are paid off you'll have money left to save.

You should consider where you plan to put your excess income. If you choose to invest your money in bonds or stocks, you may lose it if the stock exchange falls. However, if the money is put into savings accounts, it will compound over time.

Consider, for example: $100 per week is a savings goal. It would add up towards $500 over five-years. In six years you'd have $1000 saved. You'd have almost $3,000 in savings by the end of eight years. You'd have close to $13,000 saved by the time you hit ten years.

Your savings account will be nearly $40,000 by the end 15 years. This is quite remarkable. However, if you had invested that same amount in the stock market during the same period, you'd have earned interest on your money along the way. Instead of $40,000 in savings, you would have more than 57,000.

This is why it is so important to understand how to properly manage your finances. You might end up with more money than you expected.

Which side hustles are most lucrative?

A side hustle is an industry term for any additional income streams that supplement your main source of revenue.

Side hustles are important because they make it possible to earn extra money for fun activities as well as bills.

Side hustles not only help you save money for retirement but also give you flexibility and can increase your earning potential.

There are two types. Online side hustles can be passive or active. These include ecommerce shops, blogging and freelancing. Active side hustles include jobs such as dog walking, tutoring, and selling items on eBay.

The best side hustles make sense for you and fit well within your lifestyle. If you love working out, consider starting a fitness business. You might consider working as a freelance landscaper if you love spending time outdoors.

Side hustles can be found everywhere. You can find side hustles anywhere.

Why not start your own graphic design company? Perhaps you're an experienced writer so why not go ghostwriting?

Do your research before starting any side-business. When the opportunity presents itself, be prepared to jump in and seize it.

Side hustles don't have to be about making money. Side hustles are about creating wealth and freedom.

There are so many ways to make money these days, it's hard to not start one.

What is personal finance?

Personal finance is the art of managing your own finances to help you achieve your financial goals. It is about understanding your finances, knowing your budget, and balancing your desires against your needs.

If you master these skills, you can be financially independent. This means you are no longer dependent on anyone to take care of you. You don't need to worry about monthly rent and utility bills.

And learning how to manage your money doesn't just help you get ahead. You'll be happier all around. If you are happy with your finances, you will be less stressed and more likely to get promoted quickly.

What does personal finance matter to you? Everyone does! Personal finance is a very popular topic today. Google Trends indicates that search terms for "personal finance” have seen a 1,600% increase in searches between 2004-2014.

Today, people use their smartphones to track budgets, compare prices, and build wealth. These people read blogs like this one and watch YouTube videos about personal finance. They also listen to podcasts on investing.

Bankrate.com estimates that Americans spend on average 4 hours per day viewing TV, listening to music and playing video games, as well reading books and talking with friends. It leaves just two hours each day to do everything else important.

If you are able to master personal finance, you will be able make the most of it.

Statistics

- According to the company's website, people often earn $25 to $45 daily. (nerdwallet.com)

- Shares of Six Flags Entertainment Corp. dove 4.7% in premarket trading Thursday, after the theme park operator reported third-quarter profit and r... (marketwatch.com)

- While 39% of Americans say they feel anxious when making financial decisions, according to the survey, 30% feel confident and 17% excited, suggesting it is possible to feel good when navigating your finances. (nerdwallet.com)

- U.S. stocks could rally another 25% now that Fed no longer has ‘back against the wall' in inflation fight (marketwatch.com)

- 4 in 5 Americans (80%) say they put off financial decisions, and 35% of those delaying those decisions say it's because they feel overwhelmed at the thought of them. (nerdwallet.com)

External Links

How To

How to Make Money Even While You Sleep

Online success requires that you learn to sleep well while awake. This means more than waiting for someone to click on the link or buy your product. Making money at night is essential.

You must be able to build an automated system that can make money without you even having to move a finger. You must learn the art of automation to do this.

It would be helpful if you could become an expert at creating software systems that automatically perform tasks. That way, you can focus on making money while you sleep. You can even automate yourself out of a job.

This is the best way to identify these opportunities. Start by listing all of your daily problems. Next, ask yourself if there are any ways you could automate them.

Once you have done this, you will likely realize that there are many ways you can generate passive income. Now you need to choose which is most profitable.

Perhaps you can create a website building tool that automates web design if, for example, you are a webmaster. You might also be able to create templates for logo production that you can use in an automated way if you're a graphic designer.

Or, if you own a business, perhaps you could create a software program that allows you to manage multiple clients simultaneously. There are many possibilities.

As long as you can come up with a creative idea that solves a problem, you can automate it. Automation is the key to financial freedom.