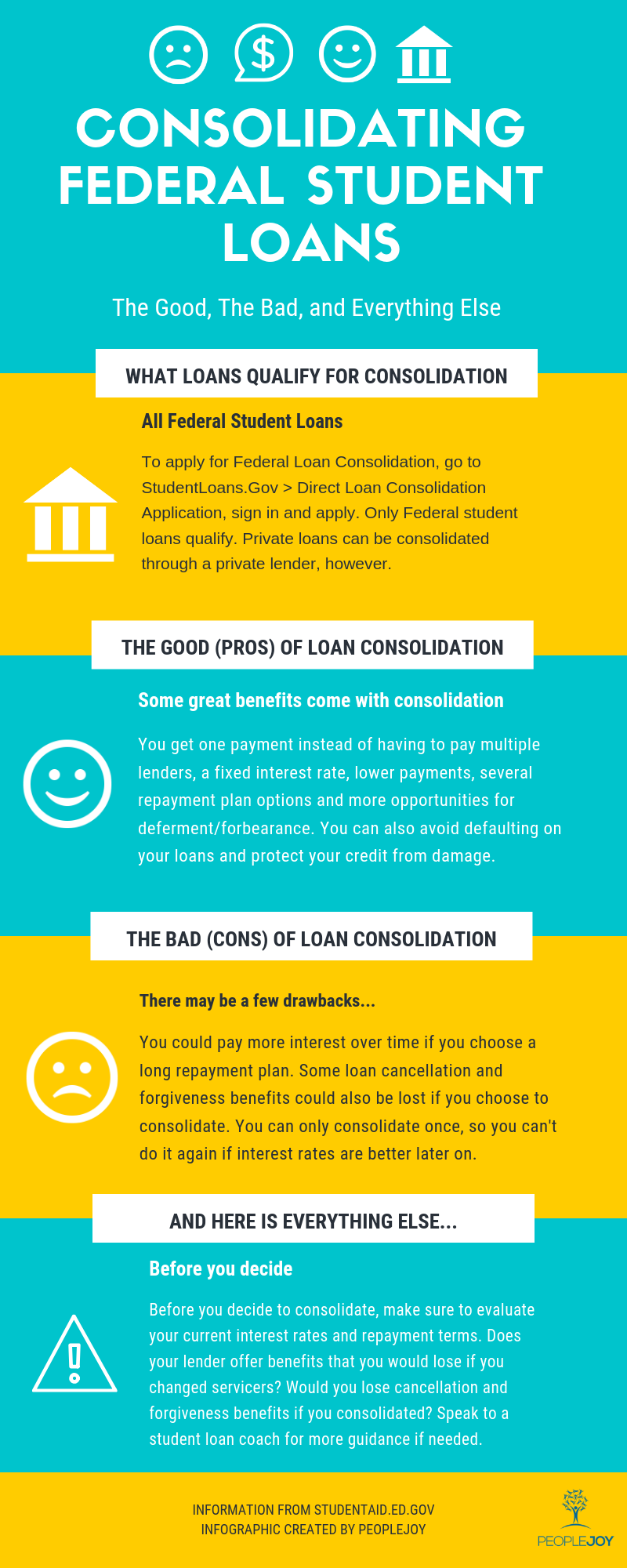

Consolidating multiple student loans into one loan may be a good option. Federal Direct Student Loan Program can offer consolidation loans. These loans offer the convenience and flexibility of one monthly repayment, while also allowing the borrower to have an extended loan term. You can also consolidate your debt to get a loan that offers better terms.

Repayment plan

There are several options available to consolidate student loan debts into one monthly payment. Apply for a consolidation loan. You have many repayment options with these loans, including income-driven and graduated payment plans. These options will make your payments less expensive and make it more easy to repay your debt.

The amount of money you wish to borrow and the time it is possible to repay the money will affect the repayment plan. A standard repayment plan is expected to last ten years. It offers the lowest payments and will help you save the most interest. Your monthly payments might be higher than other repayment plans.

Interest rate

Consolidating student loans will result in a new interest rate equal to the average of all your loans. This interest rate will remain the same for the duration of the loan. When deciding whether a consolidation loan is the right option for you, it is important to take this into consideration. Some consolidation loans have fixed interest rates while others have variable ones.

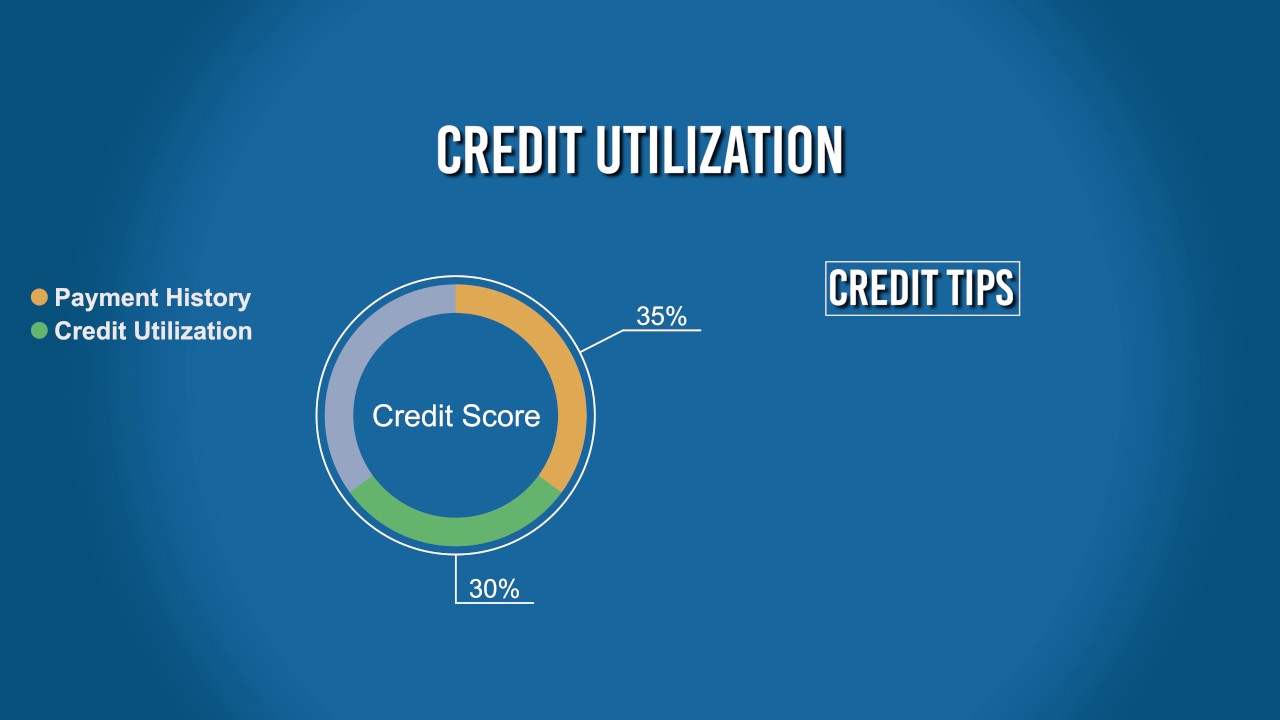

Consolidating your loans is an excellent way to lower your payments. You'll get one monthly bill to worry about and you'll avoid the risk of missing a payment, which can negatively impact your credit score. You can have negative consequences for up to seven years if you default. It's important that you avoid this as much possible. You can avoid late payments by using automatic debits to pay student loans. This will also help maintain a stable credit rating. For missed payments to be avoided and to avoid penalties, you must make your payments on the due date.

Cost

As the cost of student loans increases, many consolidation companies are scrambling to get your business. Lenders are encouraging you to consolidate as soon as possible, even before interest rates rise almost two percentage points to 7.14 per cent on July 1. Lenders are offering hundreds of dollars in student checks to students who make their first payment.

Consolidating student loans can simplify your monthly payments and help you save hundreds of dollars. CNBC Select found that average students can expect to save between $4,000 - $7000 on their student loans over the lifetime of their loans.

Direct consolidation loan

Direct consolidation loan for student loans is a type of loan that combines a number of student loans into one. This means that you will pay less monthly and have a longer loan term. This type of loan is great if you have multiple debts to pay. However, you should be cautious and compare shop carefully. You don't want to end up with a debt that is larger than you can afford to pay off.

A Direct Consolidation loan allows you to consolidate multiple federal student debts into one, easy-to-manage monthly payment. You can choose which servicer to use and make one monthly payment with this type of loan. It takes between four and six weeks to apply for a Direct Consolidation Loan.

FAQ

What are the top side hustles that will make you money in 2022

The best way today to make money is to create value in the lives of others. You will make money if you do this well.

While you might not know it, your contribution to the world has been there since day one. As a baby, your mother gave you life. When you learned how to walk, you gave yourself a better place to live.

You will always make more if your efforts are to be a positive influence on those around you. In fact, the more you give, the more you'll receive.

Value creation is a powerful force that everyone uses every day without even knowing it. Whether you're cooking dinner for your family, driving your kids to school, taking out the trash, or simply paying the bills, you're constantly creating value.

There are actually nearly 7 billion people living on Earth today. This means that every person creates a tremendous amount of value each day. Even if you create only $1 per hour of value, you would be creating $7,000,000 a year.

That means that if you could find ten ways to add $100 to someone's life per week, you'd earn an extra $700,000 a year. Think about that - you would be earning far more than you currently do working full-time.

Now let's pretend you wanted that to be doubled. Let's say that you found 20 ways each month to add $200 to someone else's life. Not only would you earn another $14.4 million dollars annually, you'd also become incredibly wealthy.

There are millions of opportunities to create value every single day. This includes selling ideas, products, or information.

Although we tend to spend a lot of time focusing on our careers and income streams, they are just tools that allow us to achieve our goals. The ultimate goal is to assist others in achieving theirs.

Create value to make it easier for yourself and others. My free guide, How To Create Value and Get Paid For It, will help you get started.

How much debt is too much?

There is no such thing as too much cash. You will eventually run out money if you spend more than your income. Because savings take time to grow, it is best to limit your spending. When you run out of money, reduce your spending.

But how much can you afford? There isn't an exact number that applies to everyone, but the general rule is that you should aim to live within 10% of your income. You'll never go broke, even after years and years of saving.

This means that, if you have $10,000 in a year, you shouldn’t spend more monthly than $1,000. If you make $20,000, you should' t spend more than $2,000 per month. And if you make $50,000, you shouldn't spend more than $5,000 per month.

It's important to pay off any debts as soon and as quickly as you can. This includes student loans and credit card bills. You'll be able to save more money once these are paid off.

You should also consider whether you would like to invest any surplus income. If the stock market drops, your money could be lost if you put it towards bonds or stocks. However, if the money is put into savings accounts, it will compound over time.

As an example, suppose you save $100 each week. It would add up towards $500 over five-years. You'd have $1,000 saved by the end of six year. In eight years, you'd have nearly $3,000 in the bank. By the time you reach ten years, you'd have nearly $13,000 in savings.

In fifteen years you will have $40,000 saved in your savings. Now that's quite impressive. However, this amount would have earned you interest if it had been invested in stock market during the exact same period. Instead of $40,000, you'd now have more than $57,000.

It is important to know how to manage your money effectively. A poor financial management system can lead to you spending more than you intended.

Which side hustles have the highest potential to be profitable?

A side hustle is an industry term for any additional income streams that supplement your main source of revenue.

Side hustles are important as they can provide additional income for bills or fun activities.

Side hustles may also allow you to save more money for retirement and give you more flexibility in your work schedule. They can even help you increase your earning potential.

There are two types of side hustles: passive and active. Passive side hustles include online businesses such as e-commerce stores, blogging, and freelancing. Some examples of active side hustles include dog walking, tutoring and selling items on eBay.

Side hustles that work for you are easy to manage and make sense. A fitness business is a great option if you enjoy working out. You might consider working as a freelance landscaper if you love spending time outdoors.

There are many side hustles that you can do. Side hustles can be found anywhere.

Why not start your own graphic design company? You might also have writing skills, so why not start your own ghostwriting business?

Be sure to research thoroughly before you start any side hustle. So when an opportunity presents itself, you will be prepared to take it.

Remember, side hustles aren't just about making money. Side hustles are about creating wealth and freedom.

There are so many ways to make money these days, it's hard to not start one.

How to create a passive income stream

To make consistent earnings from one source you must first understand why people purchase what they do.

It means listening to their needs and desires. It is important to learn how to communicate with people and to sell to them.

The next step is how to convert leads and sales. You must also master customer service to retain satisfied clients.

Although you might not know it, every product and service has a customer. If you know who this buyer is, your entire business can be built around him/her.

To become a millionaire takes hard work. It takes even more work to become a billionaire. Why? Because to become a millionaire, you first have to become a thousandaire.

And then you have to become a millionaire. Finally, you must become a billionaire. The same goes for becoming a billionaire.

How can someone become a billionaire. It starts with being a millionaire. All you have to do in order achieve this is to make money.

However, before you can earn money, you need to get started. Let's discuss how to get started.

What is the easiest passive source of income?

There are many different ways to make online money. However, most of these require more effort and time than you might think. How do you find a way to earn more money?

Finding something you love is the key to success, be it writing, selling, marketing or designing. It is possible to make money from your passion.

For example, let's say you enjoy creating blog posts. Your blog will provide useful information on topics relevant to your niche. When readers click on the links in those articles, they can sign up for your emails or follow you via social media.

This is known as affiliate marketing and you can find many resources to help get started. Here are some examples of 101 affiliate marketing tools, tips & resources.

You might also think about starting a blog to earn passive income. Again, you will need to find a topic which you love teaching. However, once your site is established, you can make it more profitable by offering ebooks, videos and courses.

While there are many options for making money online, the most effective ones are the easiest. Make sure you focus your efforts on creating useful websites and blogs if you truly want to make a living online.

Once you've created your website promote it through social media like Facebook, Twitter LinkedIn, Pinterest Instagram, YouTube, and many other sites. This is known as content marketing and it's a great way to drive traffic back to your site.

What is the difference in passive income and active income?

Passive income can be defined as a way to make passive income without any work. Active income is earned through hard work and effort.

When you make value for others, that is called active income. It is when someone buys a product or service you have created. For example, selling products online, writing an ebook, creating a website, advertising your business, etc.

Passive income is great because you can focus on other important things while still earning money. Most people don't want to work for themselves. Therefore, they opt to earn passive income by putting their efforts and time into it.

The problem is that passive income doesn't last forever. If you wait too long to generate passive income, you might run out of money.

It is possible to burn out if your passive income efforts are too intense. Start now. You'll miss out on the best opportunities to maximize your earning potential if you wait to build passive income.

There are 3 types of passive income streams.

-

These include starting a business, owning a franchise or becoming a freelancer. You could also rent the property, such as real-estate, to other people.

-

These include stocks and bonds and mutual funds. ETFs are also investments.

-

Real Estate includes flipping houses, purchasing land and renting properties.

Statistics

- These websites say they will pay you up to 92% of the card's value. (nerdwallet.com)

- As mortgage rates dip below 7%, ‘millennials should jump at a 6% mortgage like bears grabbing for honey' New homeowners and renters bear the brunt of October inflation — they're cutting back on eating out, entertainment and vacations to beat rising costs (marketwatch.com)

- According to the company's website, people often earn $25 to $45 daily. (nerdwallet.com)

- According to a June 2022 NerdWallet survey conducted online by The Harris Poll. (nerdwallet.com)

- Mortgage rates hit 7.08%, Freddie Mac says Most Popular (marketwatch.com)

External Links

How To

How to Make Money While You Are Asleep

It is essential that you can learn to sleep while you are awake in order to be successful online. This means learning to do more than wait for someone to click on your link or buy your product. Make money while you're sleeping.

This means you must create an automated system to make money, without even lifting a finger. To do that, you must master the art of automation.

It would be helpful if you could become an expert at creating software systems that automatically perform tasks. You can then focus on making money, even while you're sleeping. Automating your job can be a great option.

It is best to keep a running list of the problems you face each day to help you find these opportunities. Consider automating them.

Once you've done this, it's likely that you'll realize there are many passive income streams. You now need to decide which one would be the most profitable.

You could, for example, create a website builder that automates creating websites if you are webmaster. Or if you are a graphic designer, perhaps you could create templates that can be used to automate the production of logos.

Perhaps you are a business owner and want to develop software that allows multiple clients to be managed at once. There are many possibilities.

You can automate anything as long you can think of a solution to a problem. Automating is key to financial freedom.