Your debt-to income ratio refers to the portion of your monthly income used to pay your debts. Your debt-toincome ratio will be greater if your total debt is higher than your monthly income. To keep your ratio low you should keep your credit card balances to ten per cent of your available credit. However, this may not be possible for everyone.

Keeping your debt-to-income ratio at or below 43%

A debt-to-income ratio is a key component of obtaining a mortgage. A higher ratio may make it harder for you to qualify. The ratio is not an exact formula, but there are accepted guidelines. In general, a debt-to-income ratio of under 43% is a good target for most lenders.

It will be easier to obtain a mortgage or another loan if your debt-to income ratio is below 43%. High DTIs may restrict your eligibility for a mortgage or other loan. It may also result in more restrictive terms and higher interest rates. High DTI borrowers are considered risky by lenders who may charge higher interest rates or impose severe penalties for late payments.

It is essential to keep your debt/income ratio under 43% in order to qualify for a mortgage. Although most lenders require a DTI lower than 43% for mortgages, this is not a requirement for all loans. It is possible to improve your credit score by using a debt management program or debt relief plan to reduce your debt to income ratio.

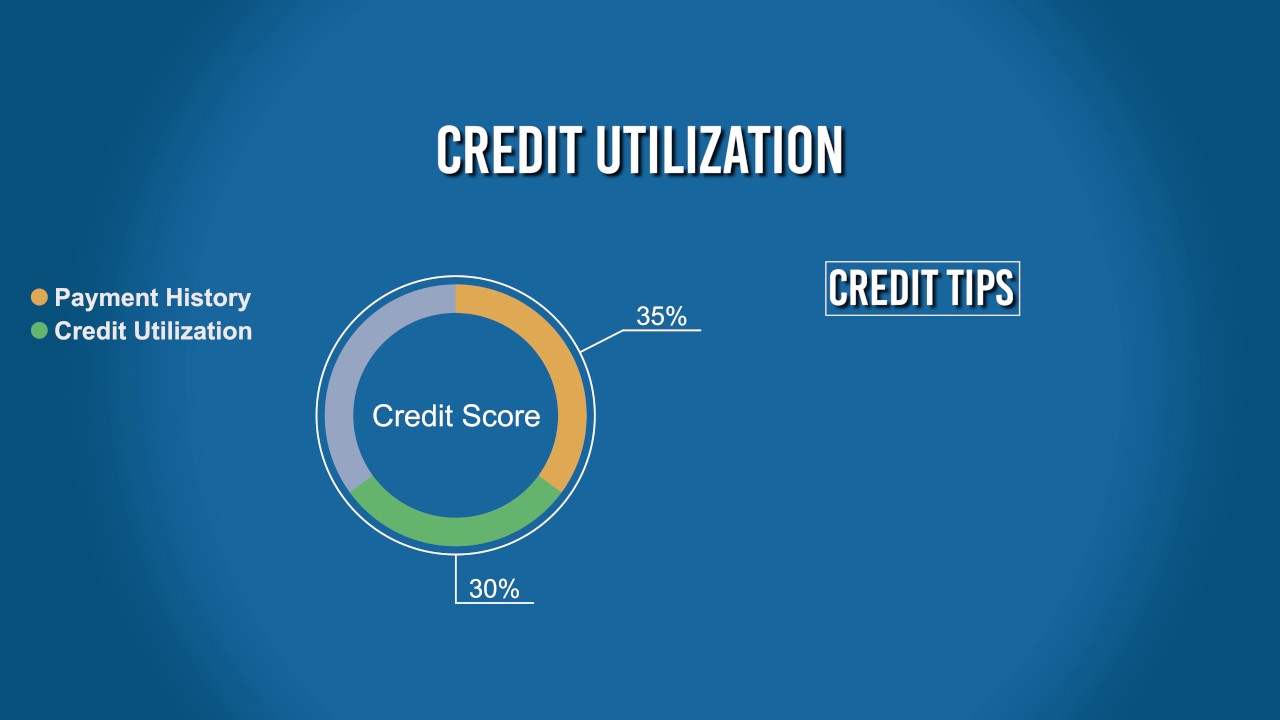

Maintain a credit card balance of 10% of your available credit

An excellent way to improve your financial condition is to keep your credit cards balances below 10%. Paying your monthly installments on time will help you save money on interest costs and fees. Smart investors also believe that a low ratio of debt to credit is essential for increasing your net worth. Your debt to credit ratio can be calculated by subtracting the total amount that you owe on all of your credit cards from the total amount of credit available.

You should also keep your credit utilization below 30%. Every purchase you make will affect your credit utilization ratio. It is best to keep your credit utilization ratio below 30 percent in order to maintain a healthy credit score.

FAQ

Is there a way to make quick money with a side hustle?

If you really want to make money fast, you'll have to do more than create a product or service that solves a problem for someone.

You also have to find a way to position yourself as an authority in whatever niche you choose to fill. That means building a reputation online as well as offline.

The best way to build a reputation is to help others solve problems. It is important to consider how you can help the community.

Once you've answered that question, you'll immediately be able to figure out which areas you'd be most suited to tackle. There are many ways to make money online.

When you really look, you will notice two main side hustles. The first type is selling products and services directly, while the second involves offering consulting services.

Each approach has its pros and cons. Selling products and services provides instant gratification because once you ship your product or deliver your service, you receive payment right away.

The flip side is that you won't be able achieve the level you desire without building relationships and trust with potential clients. These gigs are also highly competitive.

Consulting helps you grow your company without worrying about shipping goods or providing service. But it takes longer to establish yourself as an expert in your field.

If you want to succeed at any of the options, you have to learn how identify the right clients. This requires a little bit of trial and error. It pays off in the end.

How can rich people earn passive income?

If you're trying to create money online, there are two ways to go about it. You can create amazing products and services that people love. This is what we call "earning money".

Another way is to create value for others and not spend time creating products. This is "passive" income.

Let's suppose you have an app company. Your job is development apps. But instead of selling them directly to users, you decide to give them away for free. It's a great model, as it doesn't depend on users paying. Instead, advertising revenue is your only source of income.

Customers may be charged monthly fees in order to sustain your business while you are building it.

This is how the most successful internet entrepreneurs make money today. They focus on providing value to others, rather than making stuff.

Which side hustles are the most lucrative in 2022

It is best to create value for others in order to make money. You will make money if you do this well.

It may seem strange, but your creations of value have been going on since the day you were born. Your mommy gave you life when you were a baby. You made your life easier by learning to walk.

You'll continue to make more if you give back to the people around you. In fact, the more value you give, then the more you will get.

Everyone uses value creation every day, even though they don't know it. You're creating value all day long, whether you're making dinner for your family or taking your children to school.

Today, Earth is home for nearly 7 million people. This means that every person creates a tremendous amount of value each day. Even if you only create $1 worth of value per hour, you'd be creating $7 million dollars a year.

You could add $100 per week to someone's daily life if you found ten more. That would make you an additional $700,000 annually. You would earn far more than you are currently earning working full-time.

Now let's pretend you wanted that to be doubled. Let's assume you discovered 20 ways to make $200 more per month for someone. Not only would this increase your annual income by $14.4 million, but it also makes you extremely rich.

Every single day, there are millions more opportunities to create value. This includes selling ideas, products, or information.

Even though we spend much of our time focused on jobs, careers, and income streams, these are merely tools that help us accomplish our goals. Ultimately, the real goal is to help others achieve theirs.

You can get ahead if you focus on creating value. My free guide, How To Create Value and Get Paid For It, will help you get started.

What is the distinction between passive income, and active income.

Passive income refers to making money while not working. Active income requires hardwork and effort.

Active income is when you create value for someone else. Earn money by providing a service or product to someone. Examples include creating a website, selling products online and writing an ebook.

Passive income allows you to be more productive while making money. Most people don't want to work for themselves. People choose to work for passive income, and so they invest their time and effort.

The problem is that passive income doesn't last forever. If you wait too long to generate passive income, you might run out of money.

In addition to the danger of burnout, if you spend too many hours trying to generate passive income, So it's best to start now. If you wait until later to start building passive income, you'll probably miss out on opportunities to maximize your earnings potential.

There are three types of passive income streams:

-

There are several options available for business owners: you can start a company, buy a franchise and become a freelancer. Or rent out your property.

-

Investments - these include stocks and bonds, mutual funds, and ETFs

-

Real Estate includes flipping houses, purchasing land and renting properties.

Why is personal financing important?

For anyone to be successful in life, financial management is essential. We live in a world with tight finances and must make tough decisions about how we spend our hard earned cash.

So why do we put off saving money? Is there something better to invest our time and effort on?

Both yes and no. Yes because most people feel guilty about saving money. Yes, but the more you make, the more you can invest.

Focusing on the big picture will help you justify spending your money.

Controlling your emotions is key to financial success. Focusing on the negative aspects in your life will make it difficult to think positive thoughts.

You may also have unrealistic expectations about how much money you will eventually accumulate. This is because you haven't learned how to manage your finances properly.

After mastering these skills, it's time to learn how to budget.

Budgeting means putting aside a portion every month for future expenses. Planning will save you money and help you pay for your bills.

So now that you know how to allocate your resources effectively, you can begin to look forward to a brighter financial future.

What side hustles are the most profitable?

Side hustles are income streams that add to your primary source of income.

Side hustles are important as they can provide additional income for bills or fun activities.

Side hustles not only help you save money for retirement but also give you flexibility and can increase your earning potential.

There are two types: active and passive side hustles. Online side hustles can be passive or active. These include ecommerce shops, blogging and freelancing. You can also do side hustles like tutoring and dog walking.

Side hustles that make sense and work well with your lifestyle are the best. If you love working out, consider starting a fitness business. If you love to spend time outdoors, consider becoming an independent landscaper.

Side hustles are available anywhere. Find side hustle opportunities wherever you are already spending your time, whether that's volunteering or learning.

One example is to open your own graphic design studio, if graphic design experience is something you have. Perhaps you are a skilled writer, why not open your own graphic design studio?

Do your research before starting any side-business. So when an opportunity presents itself, you will be prepared to take it.

Side hustles can't be just about making a living. Side hustles are about creating wealth and freedom.

And with so many ways to earn money today, there's no excuse to start one!

Statistics

- 4 in 5 Americans (80%) say they put off financial decisions, and 35% of those delaying those decisions say it's because they feel overwhelmed at the thought of them. (nerdwallet.com)

- U.S. stocks could rally another 25% now that Fed no longer has ‘back against the wall' in inflation fight (marketwatch.com)

- As mortgage rates dip below 7%, ‘millennials should jump at a 6% mortgage like bears grabbing for honey' New homeowners and renters bear the brunt of October inflation — they're cutting back on eating out, entertainment and vacations to beat rising costs (marketwatch.com)

- These websites say they will pay you up to 92% of the card's value. (nerdwallet.com)

- Etsy boasted about 96 million active buyers and grossed over $13.5 billion in merchandise sales in 2021, according to data from Statista. (nerdwallet.com)

External Links

How To

How To Make Money Online

Today's methods of making money online are very different from those used ten years ago. It is changing how you invest your money. There are many ways that you can make passive income. But, they all require a large initial investment. Some methods can be more challenging than others. However, there are many things you need to do before investing your hard-earned funds in anything online.

-

Find out what kind of investor you are. You might be attracted to PTC sites (Pay per Click), which pay you for clicking ads. However, if long-term earning potential is more important to you, you might consider affiliate marketing opportunities.

-

Do your research. Before you commit to any program, you must do your homework. Review, testimonials and past performance records are all good places to start. You don’t want to spend your time and energy on something that doesn’t work.

-

Start small. Don't jump straight into one large project. Instead, you should start by building something small. This will help you learn the ropes and determine whether this type of business is right for you. After you feel confident enough, you can start working on larger projects.

-

Get started now! You don't have to wait too long to start making money online. Even if it's been years since you last worked full-time, you still have enough time to build a solid portfolio niche websites. All that's required is a good idea as well as some commitment. You can take action right now by implementing your ideas.