If you are looking to lower your credit card interest rate, it is possible that the first person you contact might not be the right choice. Even if your payment history is excellent, it may not be possible to lower your interest rates. It is important to highlight your outstanding customer service and payment history. In your conversation, be sure to include any competing offers.

There are other options to lower credit card interest rates

There are many ways to negotiate with your credit company for a lower rate. First, take down your current interest rate, how often you use it, and how much. This information will make it easier to negotiate your loan terms with the lender. Note any other cards having lower APRs. This will remind the lender to take your business elsewhere if they are not willing to lower your rate.

You may be eligible to receive a lower interest rate if you pay your monthly balance in full. However, different credit card issuers have different policies when it comes to granting rate decrease requests. When deciding whether to offer a lower rate, they also take into account your credit history.

Alternatives to lower credit card interest charges

There are many ways that people can negotiate lower interest rates for their credit cards. Call your credit card issuer to explain why you would like a reduction. You should mention your history with the company and good credit. Additionally, mention that you are currently searching for a lower interest rates.

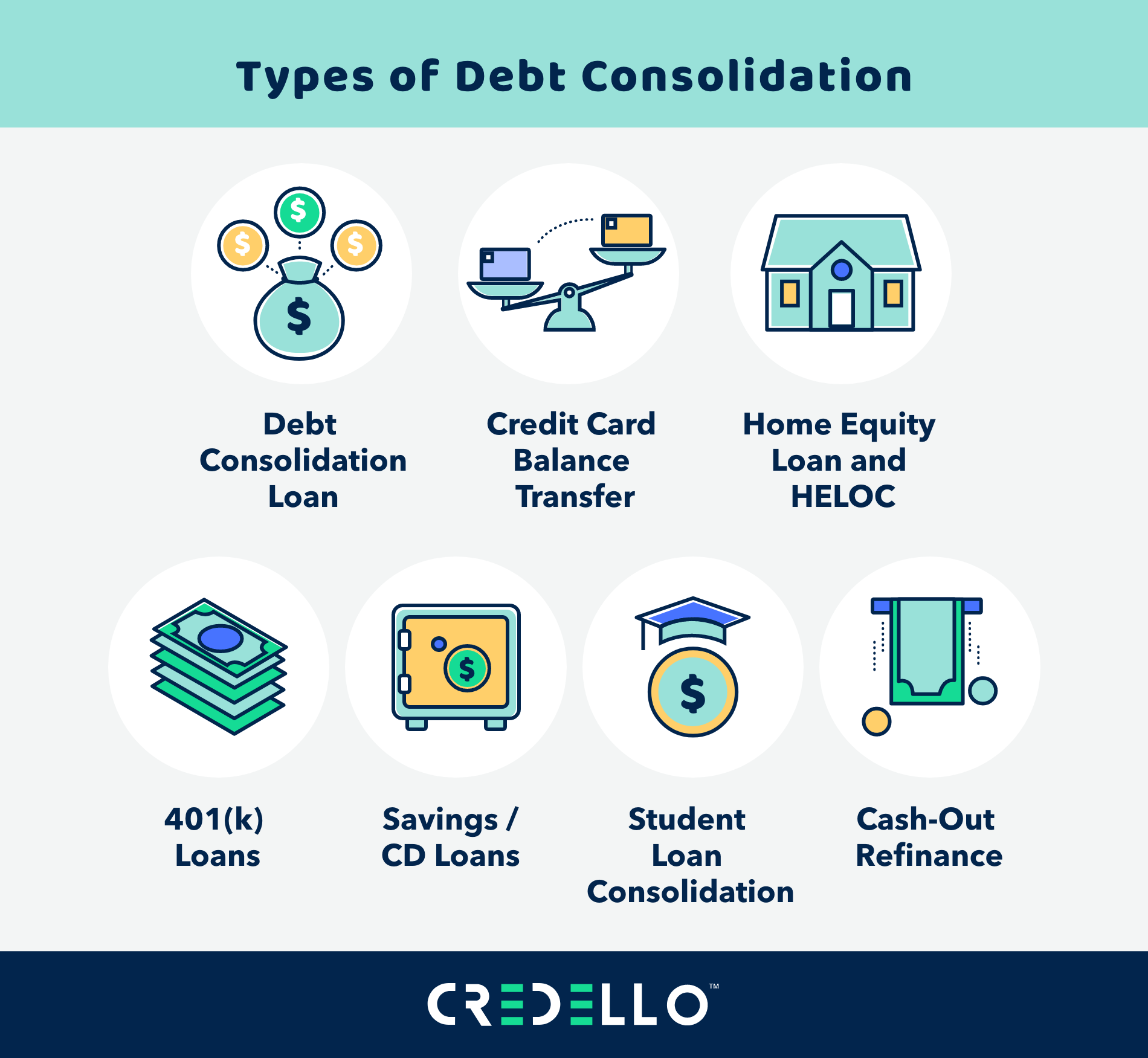

Another option is to consolidate your credit card balances. Both options will reduce your monthly costs and increase your interest rates. These methods are unlikely to affect your credit score. However, some consolidation methods may make an inquiry into your credit report. Another credit card offer can help you negotiate lower rates.

You might be surprised to know that your credit cards company will offer lower rates if they are requested. Although they aren't foolproof these techniques can help you save money over time. The entire process can be completed in under 15 minutes. You may even receive a lower interest rates.

Alternatives to lowering credit card interest rates by making on-time payments

You can lower your interest rates by making regular payments to your credit card. A reduction in your rate will allow you to start saving money and reduce your debt. This is an important decision because defaulting on a loan can cause credit problems for years.

You can also negotiate with your credit card companies to lower your interest rate. These companies have been known to lower the interest rates of their clients by reducing their minimum monthly payments. Some of these negotiation tactics will not affect your credit score, while others may require inquiries.

Credit card companies are not required by law to lower the interest rate. However, they will consider it if you request. Compare your current rate to other interest rates. You can request more information from your credit card company if your request is denied. If your request is not granted immediately, you might need to wait longer or make more regular payments until the interest rate drops.

FAQ

Which side hustles have the highest potential to be profitable?

Side hustle is a term used to describe any side income streams that can supplement your main source.

Side hustles are very important because they provide extra money for bills and fun activities.

Side hustles are a way to make more money, save time, and increase your earning power.

There are two types of side hustles: passive and active. Online businesses like e-commerce, blogging, and freelance work are all passive side hustles. You can also do side hustles like tutoring and dog walking.

Side hustles that make sense and work well with your lifestyle are the best. A fitness business is a great option if you enjoy working out. Consider becoming a freelance landscaper, if you like spending time outdoors.

Side hustles can be found everywhere. You can find side hustles anywhere.

Why not start your own graphic design company? Maybe you're a writer and want to become a ghostwriter.

No matter what side hustle you decide to pursue, do your research thoroughly and plan ahead. This way, when the opportunity arises, you'll be ready to jump right in and take advantage of it.

Side hustles don't have to be about making money. Side hustles can be about creating wealth or freedom.

And with so many ways to earn money today, there's no excuse to start one!

What is personal finances?

Personal finance refers to managing your finances in order to achieve your personal and professional goals. This means understanding where your money goes and what you can afford. And, it also requires balancing the needs of your wants against your financial goals.

Learning these skills will make you financially independent. You won't need to rely on anyone else for your needs. You don't need to worry about monthly rent and utility bills.

Learning how to manage your finances will not only help you succeed, but it will also make your life easier. It makes you happier overall. Positive financial health can make it easier to feel less stressed, be promoted more quickly, and live a happier life.

Who cares about personal finances? Everyone does! Personal finance is the most popular topic on the Internet. According to Google Trends, searches for "personal finance" increased by 1,600% between 2004 and 2014.

Today, people use their smartphones to track budgets, compare prices, and build wealth. They read blogs like this one, watch videos about personal finance on YouTube, and listen to podcasts about investing.

In fact, according to Bankrate.com, Americans spend an average of four hours a day watching TV, listening to music, playing video games, surfing the Web, reading books, and talking with friends. There are only two hours each day that can be used to do all the important things.

Personal finance is something you can master.

How can a novice earn passive income as a contractor?

Start with the basics, learn how to create value for yourself, and then find ways to make money from that value.

You may have some ideas. If you do, great! If not, you should start to think about how you could add value to others and what you could do to make those thoughts a reality.

Online earning money is easy if you are looking for opportunities that match your interests and skills.

There are many ways to make money while you sleep, such as by creating websites and apps.

Reviewing products is a great way to express your creativity. Or if you're creative, you might consider designing logos or artwork for clients.

No matter what focus you choose, be sure to find something you like. You'll be more likely to stick with it over the long-term.

Once you have found a product/service that you enjoy selling, you will need to find a way to make it monetizable.

There are two main options. You could charge a flat rate (like a freelancer), or per project (like an agencies).

Either way, once you have established your rates, it's time to market them. This includes sharing your rates on social media and emailing your subscribers, as well as posting flyers and other promotional materials.

Keep these three tips in your mind as you promote your business to increase your chances of success.

-

Market like a professional: Always act professional when you do anything in marketing. You never know who will be reviewing your content.

-

Know your subject matter before you speak. Fake experts are not appreciated.

-

Avoid spamming - unless someone specifically requests information, don't email everyone in your contact list. Do not send out a recommendation if someone asks.

-

Use a good email service provider. Yahoo Mail or Gmail are both free.

-

You can monitor your results by tracking how many people open your emails, click on links and sign up to your mailing lists.

-

You can measure your ROI by measuring the number of leads generated for each campaign and determining which campaigns are most successful in converting them.

-

Get feedback - ask friends and family whether they would be interested in your services, and get their honest feedback.

-

Try different strategies - you may find that some work better than others.

-

Keep learning - continue to grow as a marketer so you stay relevant.

What is the distinction between passive income, and active income.

Passive income can be defined as a way to make passive income without any work. Active income requires effort and hard work.

If you are able to create value for somebody else, then that's called active income. When you earn money because you provide a service or product that someone wants. You could sell products online, write an ebook, create a website or advertise your business.

Passive income is great as it allows you more time to do important things while still making money. However, most people don't like working for themselves. So they choose to invest time and energy into earning passive income.

The problem with passive income is that it doesn't last forever. If you wait too long before you start to earn passive income, it's possible that you will run out.

In addition to the danger of burnout, if you spend too many hours trying to generate passive income, So it's best to start now. You'll miss out on the best opportunities to maximize your earning potential if you wait to build passive income.

There are three types or passive income streams.

-

There are many options for businesses: You can own a franchise, start a blog, become a freelancer or rent out real estate.

-

Investments include stocks, bonds, mutual funds, ETFs, and ETFs.

-

Real Estate includes flipping houses, purchasing land and renting properties.

Why is personal finance so important?

If you want to be successful, personal financial management is a must-have skill. Our world is characterized by tight budgets and difficult decisions about how to spend it.

So why do we put off saving money? What is the best thing to do with our time and energy?

The answer is yes and no. Yes, most people feel guilty saving money. It's not true, as more money means more opportunities to invest.

You'll always be able justify spending your money wisely if you keep your eyes on the bigger picture.

It is important to learn how to control your emotions if you want to become financially successful. Focusing on the negative aspects in your life will make it difficult to think positive thoughts.

Also, you may have unrealistic expectations about the amount of money that you will eventually accumulate. This is because you haven't learned how to manage your finances properly.

Once you have mastered these skills you will be ready for the next step, learning how budgeting works.

Budgeting is the act of setting aside a portion of your income each month towards future expenses. Planning will allow you to avoid buying unnecessary items and provide sufficient funds to pay your bills.

Once you have mastered the art of allocating your resources efficiently, you can look forward towards a brighter financial tomorrow.

How to make passive income?

To generate consistent earnings from one source, you have to understand why people buy what they buy.

This means that you must understand their wants and needs. This requires you to be able connect with people and make sales to them.

Next, you need to know how to convert leads to sales. The final step is to master customer service in order to keep happy clients.

You may not realize this, but every product or service has a buyer. You can even design your entire business around that buyer if you know what they are.

You have to put in a lot of effort to become millionaire. To become a billionaire, it takes more effort. Why? Why?

And then you have to become a millionaire. And finally, you have to become a billionaire. You can also become a billionaire.

How does one become billionaire? It starts with being a millionaire. All you have to do in order achieve this is to make money.

However, before you can earn money, you need to get started. Let's look at how to get going.

Statistics

- According to a June 2022 NerdWallet survey conducted online by The Harris Poll. (nerdwallet.com)

- While 39% of Americans say they feel anxious when making financial decisions, according to the survey, 30% feel confident and 17% excited, suggesting it is possible to feel good when navigating your finances. (nerdwallet.com)

- Etsy boasted about 96 million active buyers and grossed over $13.5 billion in merchandise sales in 2021, according to data from Statista. (nerdwallet.com)

- These websites say they will pay you up to 92% of the card's value. (nerdwallet.com)

- As mortgage rates dip below 7%, ‘millennials should jump at a 6% mortgage like bears grabbing for honey' New homeowners and renters bear the brunt of October inflation — they're cutting back on eating out, entertainment and vacations to beat rising costs (marketwatch.com)

External Links

How To

How to Make Money While You Are Asleep

You must be able to fall asleep while you're awake if you want to make it big online. This means that you must be able to do more than simply wait for someone click on your link to buy your product. It is possible to make money while you are sleeping.

You must be able to build an automated system that can make money without you even having to move a finger. To do that, you must master the art of automation.

It would be beneficial to learn how to build software systems that do tasks automatically. You can then focus on making money, even while you're sleeping. You can automate your job.

To find these opportunities, you should create a list with problems that you solve every day. Then ask yourself if there is any way that you could automate them.

Once you've done that, you'll probably realize that you already have dozens of potential ways to generate passive income. Now, it's time to find the most lucrative.

For example, if you are a webmaster, perhaps you could develop a website builder that automates the creation of websites. Maybe you are a webmaster and a graphic designer. You could also create templates that could be used to automate production of logos.

Perhaps you are a business owner and want to develop software that allows multiple clients to be managed at once. There are hundreds of options.

Automating a problem can be done as long as you have a creative solution. Automating is key to financial freedom.