You might want to consolidate student loans. Federal Direct Student Loan Program can offer consolidation loans. These loans have one monthly repayment and allow the borrower to take out a longer term. Consolidating your debt may also help you to find a loan with a better term.

Repayment plan

There are several options available to consolidate student loan debts into one monthly payment. Apply for a consolidation loan. These loans come with many repayment options, including income-driven plans and graduated payment plans. These options will make your payments less expensive and make it more easy to repay your debt.

The amount that you want to borrow and the duration of your ability to pay it back will impact the repayment schedule. A typical repayment plan takes 10 years. It is the cheapest and most cost-effective option. However, your monthly payments may be higher than those of other repayment plans.

Interest rate

Consolidating student debts means the new interest rate for the loan is equal to the sum of all other loans. This interest rate will remain the same for the duration of the loan. When deciding whether a consolidation loan is the right option for you, it is important to take this into consideration. Some consolidation loans have variable interest rates, while others have fixed rates.

Consolidating your debts is a great way to reduce your monthly payments. It will give you one monthly bill, and it will eliminate the possibility of missing any payments. This will help to improve your credit score. You can have negative consequences for up to seven years if you default. It's important that you avoid this as much possible. Automatic debits are a great way to avoid late payments, maintain your credit score and keep your student loans paid on time. Pay your student loans on time each month to avoid missed payments or penalties.

Prices

Many consolidation companies are trying to secure your business, as the cost of student loans rises. Lenders will send you a flood of letters, e-mail messages and other communications to encourage consolidation. This is before interest rate increases nearly two percentage points to 7.14% on July 1. One lender offers students checks worth hundreds of dollars when they pay their first payment.

Consolidating student loans is a great option to lower your monthly payment, and potentially save hundreds of money. CNBC Select's analysis shows that an average student loan borrower can save between $4,000- $7000 over the course of their student loans.

Direct consolidation loan

Direct consolidation loan for students loans is a loan that combines multiple student loans. This results in reduced monthly repayments and a longer loan term. You may find this type of loan very helpful if you are having trouble paying multiple debts. However, it is important to compare the options and be aware of your options. It is not a good idea to have a larger debt than you can pay.

Direct Consolidation Loans allow you to consolidate multiple federal student loan debts into one simple payment. With this type of loan, you can choose the servicer you want to work with and make one single monthly payment. You can apply for a Direct Consolidation Loan in as little as four to six weeks.

FAQ

Why is personal finance important?

Personal financial management is an essential skill for anyone who wants to succeed. We live in a world with tight finances and must make tough decisions about how we spend our hard earned cash.

So why do we put off saving money? Is there nothing better to spend our time and energy on?

Yes, and no. Yes, because most people feel guilty when they save money. It's not true, as more money means more opportunities to invest.

As long as you keep yourself focused on the bigger picture, you'll always be able to justify spending your money wisely.

It is important to learn how to control your emotions if you want to become financially successful. If you are focusing on the negative aspects of your life, you will not have positive thoughts that can support you.

You may also have unrealistic expectations about how much money you will eventually accumulate. This could be because you don't know how your finances should be managed.

Once you've mastered these skills, you'll be ready to tackle the next step - learning how to budget.

Budgeting is the practice of setting aside some of your monthly income for future expenses. Planning will help you avoid unnecessary purchases and make sure you have enough money to pay your bills.

You now have the knowledge to efficiently allocate your resources and can start to see a brighter financial future.

What is the fastest way to make money on a side hustle?

If you want money fast, you will need to do more than simply create a product/service to solve a problem.

You need to be able to make yourself an authority in any niche you choose. It's important to have a strong online reputation.

Helping others solve their problems is a great way to build a name. You need to think about how you can add value to your community.

After answering that question, it's easy to identify the areas in which you are most qualified to work. There are many online ways to make money, but they are often very competitive.

But when you look closely, you can see two main side hustles. The first type is selling products and services directly, while the second involves offering consulting services.

Each approach has its pros and cons. Selling products or services offers instant gratification, as once your product is shipped or your service is delivered, you will receive payment immediately.

But, on the other hand, you might not have the success you desire if you do not spend the time to build relationships with potential clientele. Additionally, there is intense competition for these types of gigs.

Consulting helps you grow your company without worrying about shipping goods or providing service. It takes more time to become an expert in your field.

You must learn to identify the right clients in order to be successful at each option. This can take some trial and error. But it will pay off big in the long term.

How do you build passive income streams?

To generate consistent earnings from one source, you have to understand why people buy what they buy.

Understanding their needs and wants is key. You must learn how to connect with people and sell to them.

The next step is to learn how to convert leads in to sales. The final step is to master customer service in order to keep happy clients.

Every product or service has a buyer, even though you may not be aware of it. If you know the buyer, you can build your entire business around him/her.

To become a millionaire takes hard work. A billionaire requires even more work. Why? Because to become a millionaire, you first have to become a thousandaire.

And then you have to become a millionaire. Finally, you can become a multi-billionaire. The same is true for becoming billionaire.

How do you become a billionaire. You must first be a millionaire. All you have do is earn money to get there.

However, before you can earn money, you need to get started. Let's discuss how to get started.

What side hustles are most lucrative in 2022?

The best way today to make money is to create value in the lives of others. This will bring you the most money if done well.

While you might not know it, your contribution to the world has been there since day one. When you were little, you took your mommy's breastmilk and it gave you life. When you learned how to walk, you gave yourself a better place to live.

You will always make more if your efforts are to be a positive influence on those around you. In fact, the more you give, the more you'll receive.

Value creation is a powerful force that everyone uses every day without even knowing it. Whether you're cooking dinner for your family, driving your kids to school, taking out the trash, or simply paying the bills, you're constantly creating value.

In actuality, Earth is home to nearly 7 billion people right now. That's almost 7 billion people on Earth right now. This means that each person creates a remarkable amount of value every single day. Even if you only create $1 worth of value per hour, you'd be creating $7 million dollars a year.

If you could find ten more ways to make someone's week better, that's $700,000. Think about that - you would be earning far more than you currently do working full-time.

Let's say that you wanted double that amount. Let's suppose you find 20 ways to increase $200 each month in someone's life. Not only would this increase your annual income by $14.4 million, but it also makes you extremely rich.

Every day offers millions of opportunities to add value. This includes selling ideas, products, or information.

Although we tend to spend a lot of time focusing on our careers and income streams, they are just tools that allow us to achieve our goals. The ultimate goal is to assist others in achieving theirs.

If you want to get ahead, then focus on creating value. You can get my free guide, "How to Create Value and Get Paid" here.

How can a novice earn passive income as a contractor?

Begin with the basics. Once you have learned how to create value, then move on to finding ways to make more money.

You might have some ideas. If you do, great! If you do, great!

Find a job that suits your skills and interests to make money online.

For instance, if you enjoy creating websites or apps, there are lots of ways that you can generate revenue even while you sleep.

If you are more interested in writing, reviewing products might be a good option. Or if you're creative, you might consider designing logos or artwork for clients.

Whatever topic you choose to focus on, ensure that it's something you enjoy. It will be a long-lasting commitment.

Once you've identified a product/service which you would enjoy helping others to buy, you will need to determine how to monetize that product or service.

You have two options. You can charge a flat price for your services (like a freelancer), but you can also charge per job (like an agency).

In either case, once you've set your rates, you'll need to promote them. This can be done via social media, emailing, flyers, or posting them to your list.

Keep these three tips in your mind as you promote your business to increase your chances of success.

-

e professional - always act like a professional when doing anything related to marketing. You never know who will review your content.

-

Be knowledgeable about the topic you are discussing. After all, no one likes a fake expert.

-

Don't spam - avoid emailing everyone in your address book unless they specifically asked for information. Do not send out a recommendation if someone asks.

-

Use a good email service provider. Yahoo Mail or Gmail are both free.

-

Monitor your results - track how many people open your messages, click links, and sign up for your mailing lists.

-

Your ROI can be measured by measuring how many leads each campaign generates and which campaigns convert the most.

-

Ask your family and friends for feedback.

-

Test different tactics - try multiple strategies to see which ones work better.

-

You must continue learning and remain relevant in marketing.

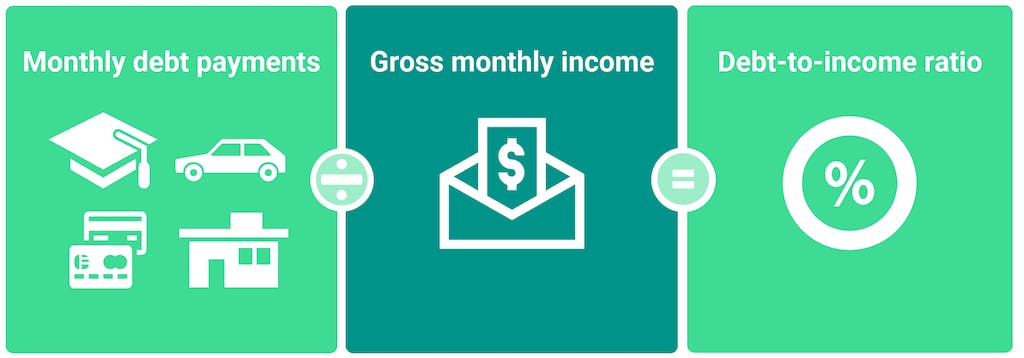

How much debt are you allowed to take on?

It is essential to remember that money is not unlimited. Spending more than you earn will eventually lead to cash shortages. Savings take time to grow. If you are running out of funds, cut back on your spending.

But how much can you afford? There's no right or wrong number, but it is recommended that you live within 10% of your income. You won't run out of money even after years spent saving.

This means that you shouldn't spend more money than $10,000 a year if your income is $10,000. If you make $20,000 per year, you shouldn't spend more then $2,000 each month. You shouldn't spend more that $5,000 per month if your monthly income is $50,000

It is important to get rid of debts as soon as possible. This applies to student loans, credit card bills, and car payments. Once those are paid off, you'll have extra money left over to save.

It's best to think about whether you are going to invest any of the surplus income. You may lose your money if the stock markets fall. But if you choose to put it into a savings account, you can expect interest to compound over time.

Let's take, for example, $100 per week that you have set aside to save. Over five years, that would add up to $500. At the end of six years, you'd have $1,000 saved. In eight years, your savings would be close to $3,000 In ten years you would have $13,000 in savings.

You'll have almost $40,000 sitting in your savings account at the end of fifteen years. That's quite impressive. But if you had put the same amount into the stock market over the same time period, you would have earned interest. Instead of $40,000 in savings, you would have more than 57,000.

You need to be able to manage your finances well. If you don't do this, you may end up spending far more than you originally planned.

Statistics

- U.S. stocks could rally another 25% now that Fed no longer has ‘back against the wall' in inflation fight (marketwatch.com)

- According to a June 2022 NerdWallet survey conducted online by The Harris Poll. (nerdwallet.com)

- As mortgage rates dip below 7%, ‘millennials should jump at a 6% mortgage like bears grabbing for honey' New homeowners and renters bear the brunt of October inflation — they're cutting back on eating out, entertainment and vacations to beat rising costs (marketwatch.com)

- Mortgage rates hit 7.08%, Freddie Mac says Most Popular (marketwatch.com)

- Shares of Six Flags Entertainment Corp. dove 4.7% in premarket trading Thursday, after the theme park operator reported third-quarter profit and r... (marketwatch.com)

External Links

How To

How to Make Money Online

Making money online is very different today from 10 years ago. Your investment strategy is changing. Although there are many options for passive income, not all require large upfront investments. Some methods can be more challenging than others. There are a few things to consider before you invest your hard-earned money into any online business.

-

Find out what type of investor are you. You might be attracted to PTC sites (Pay per Click), which pay you for clicking ads. You might also consider affiliate marketing opportunities if your goal is to make long-term money.

-

Do your research. You must research any program before you decide to commit. Review, testimonials and past performance records are all good places to start. You don't want to waste your time and energy only to realize that the product doesn't work.

-

Start small. Do not jump into a large project. Instead, start off by building something simple first. This will help to you get started and allow you to decide if this type business is right for your needs. After you feel confident enough, you can start working on larger projects.

-

Get started now! It's never too soon to start making online money. Even if it's been years since you last worked full-time, you still have enough time to build a solid portfolio niche websites. All you need is a good idea and some dedication. So go ahead and take action today!