There are many options available for consolidating student debt. These include Direct Consolidation Loans, Laurel Road, and Refinancing. In addition, there are alternatives to defaulting on student loans. You should explore all your options so that you can make an educated decision. Consolidating student loans does not entail any fees or other obligations.

Laurel Road

Laurel Road is a great option if you're in the process to refinance your student loans. The company offers refinance options with no maximum caps and for as long as 20 years. Customers also enjoy many other benefits from the company. One of these is their ability to work with a variety of payment plans, including the possibility of extending your term.

Laurel Road offers refinancing for both federal and private student loans. To qualify, you must be a citizen of the U.S. or a permanent resident of the country and have a valid I-551 form. There are requirements for the job that depend on your degree.

Direct Consolidation loan

Consolidation loans for students are offered by the Federal Direct Student Loan Program. These loans combine several student loans into one, resulting in lower monthly repayments and a longer loan term. Consolidation Loans are especially beneficial for those with large amounts of debt. Consolidation loans are not the right choice for everyone.

There are some things you should know in order to be eligible for this loan. First, at least one federal student debt must be in your possession. The federal loan must be active in repayment and have a grace period. There are 4 income-driven repayment plans available.

Refinancing

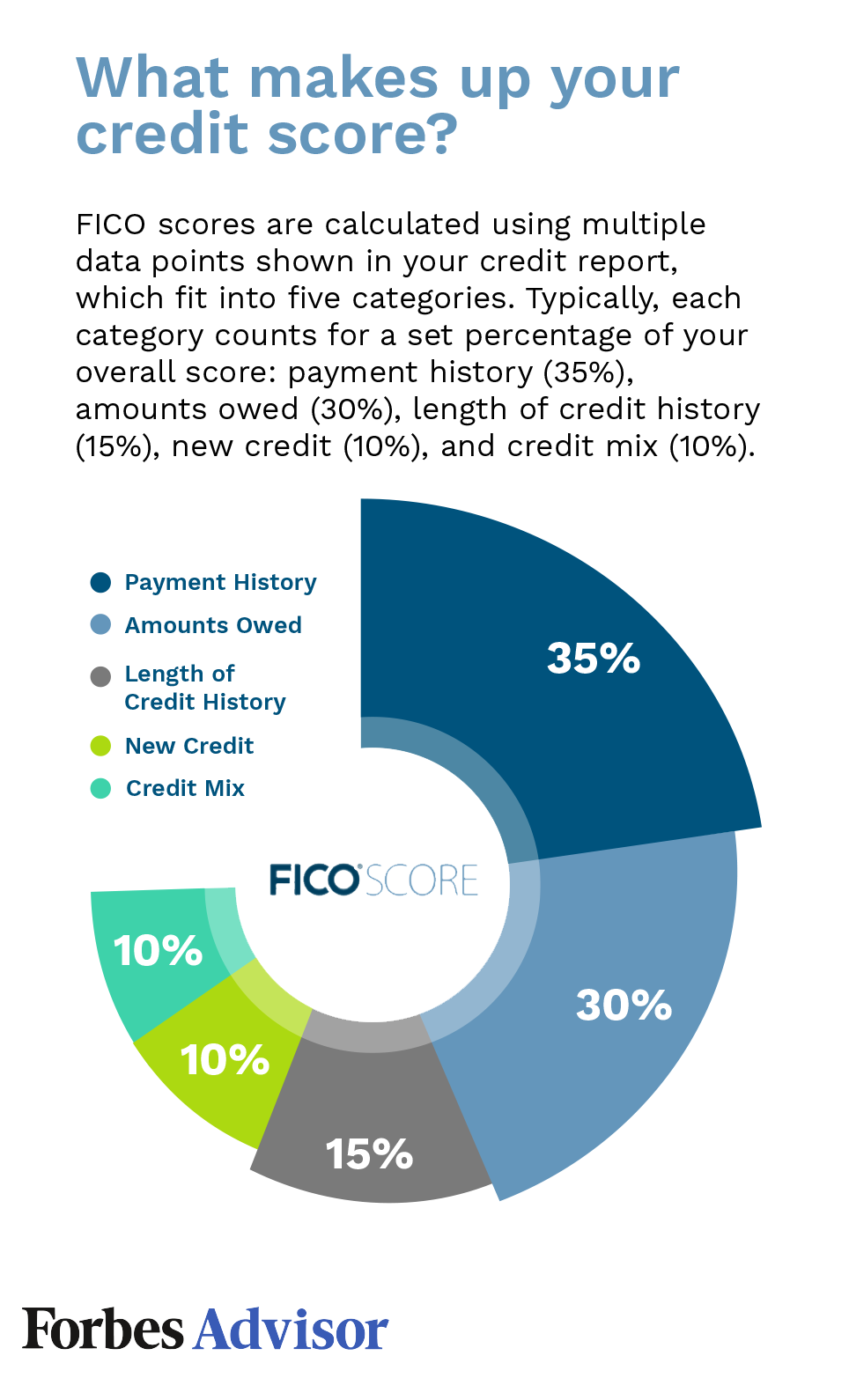

Refinancing student debt requires that you remember a few key points. First, be sure to have a strong credit score. Late payments or defaulting on student loans are not recommended as these can cause credit damage. Second, do not forget to take advantage any grace periods that your lender may offer. While defaults and late payments can be very bad, you can make the most of any grace periods provided by your lender to improve your credit score and lower monthly payments.

Third, it is important to remember that refinancing student credit debt can be difficult. When considering whether or not to approve an application for a loan, lenders will consider a borrower’s credit score and financial obligations. You won't be approved if you have poor credit. Your income will also impact your chances of getting approved.

There are alternatives to defaulting on student loan loans

There are many options for you to avoid defaulting on student loans if you find yourself in financial difficulty. For starters, you should consider deferment. This option allows you to make monthly payments based on your income. You should also be aware of the consequences of default. The consequences of defaulting with a student loan may affect your credit score. It can also make it harder to get other loans in the long-term.

You can apply for forbearance, which is a form of deferment. You should look into this option if you are able to defer your payments for a specific period of the year. A Public Service Loan Forgiveness program may also apply to you if the job you find is in a nonprofit agency or government agency. To qualify, you must make 120 qualifying payments.

FAQ

How to create a passive income stream

You must understand why people buy the things they do in order to generate consistent earnings from a single source.

This means that you must understand their wants and needs. You must learn how to connect with people and sell to them.

The next step is to learn how to convert leads in to sales. To keep clients happy, you must be proficient in customer service.

Even though it may seem counterintuitive, every product or service has its buyer. If you know who this buyer is, your entire business can be built around him/her.

To become a millionaire it takes a lot. You will need to put in even more effort to become a millionaire. Why? Why?

And then you have to become a millionaire. Finally, you must become a billionaire. The same is true for becoming billionaire.

How can someone become a billionaire. It all starts with becoming a millionaire. All you need to do to achieve this is to start making money.

Before you can start making money, however, you must get started. So let's talk about how to get started.

How does a rich person make passive income?

There are two methods to make money online. One is to create great products/services that people love. This is called "earning” money.

A second option is to find a way of providing value to others without creating products. This is "passive" income.

Let's suppose you have an app company. Your job is development apps. You decide to make them available for free, instead of selling them to users. Because you don't rely on paying customers, this is a great business model. Instead, you rely on advertising revenue.

To sustain yourself while you're building your company, you might also charge customers monthly fees.

This is the way that most internet entrepreneurs are able to make a living. They focus on providing value to others, rather than making stuff.

What is the easiest way to make passive income?

There are many different ways to make online money. Some of these take more time and effort that you might realize. How can you make it easy for yourself to make extra money?

Find something that you are passionate about, whether it's writing, design, selling, marketing, or blogging. Find a way to monetize this passion.

For example, let's say you enjoy creating blog posts. You can start a blog that shares useful information about topics in your niche. Then, when readers click on links within those articles, sign them up for emails or follow you on social media sites.

This is known as affiliate marketing and you can find many resources to help get started. For example, here's a list of 101 Affiliate Marketing Tools, Tips & Resources.

You could also consider starting a blog as another form of passive income. It's important to choose a topic you are passionate about. You can also make your site monetizable by creating ebooks, courses and videos.

While there are many methods to make money online there are some that are more effective than others. You can make money online by building websites and blogs that offer useful information.

Once you've created your website promote it through social media like Facebook, Twitter LinkedIn, Pinterest Instagram, YouTube, and many other sites. This is content marketing. It's an excellent way to bring traffic back to your website.

What is the distinction between passive income, and active income.

Passive income refers to making money while not working. Active income requires hardwork and effort.

You create value for another person and earn active income. Earn money by providing a service or product to someone. Selling products online, writing ebooks, creating websites, and advertising your business are just a few examples.

Passive income is great because you can focus on other important things while still earning money. Many people aren’t interested in working for their own money. Therefore, they opt to earn passive income by putting their efforts and time into it.

Passive income isn't sustainable forever. If you wait too long to generate passive income, you might run out of money.

If you spend too long trying to make passive income, you run the risk that your efforts will burn out. It's better to get started now than later. If you wait to start earning passive income, you might miss out opportunities to maximize the potential of your earnings.

There are three types or passive income streams.

-

Business opportunities include opening a franchise, creating a blog or freelancer, as well as renting out property like real estate.

-

Investments - these include stocks and bonds, mutual funds, and ETFs

-

Real Estate includes flipping houses, purchasing land and renting properties.

What side hustles are most lucrative in 2022?

You can make money by creating value for someone else. If you do this well, the money will follow.

It may seem strange, but your creations of value have been going on since the day you were born. Your mommy gave you life when you were a baby. Your life will be better if you learn to walk.

If you keep giving value to others, you will continue making more. In fact, the more you give, the more you'll receive.

Without even realizing it, value creation is a powerful force everyone uses every day. You are creating value whether you cook dinner, drive your kids to school, take out the trash, or just pay the bills.

Today, Earth is home for nearly 7 million people. Each person is creating an amazing amount of value every day. Even if your hourly value is $1, you could create $7 million annually.

If you could find ten more ways to make someone's week better, that's $700,000. Imagine that you'd be earning more than you do now working full time.

Let's say that you wanted double that amount. Let's say you found 20 ways to add $200 to someone's life per month. Not only would you make an additional $14.4million dollars per year, but you'd also become extremely wealthy.

Every day offers millions of opportunities to add value. This includes selling products, ideas, services, and information.

Although many of us spend our time thinking about careers and income streams, these tools are only tools that enable us to reach our goals. Ultimately, the real goal is to help others achieve theirs.

Focus on creating value if you want to be successful. My free guide, How To Create Value and Get Paid For It, will help you get started.

What is the best way for a side business to make money?

If you really want to make money fast, you'll have to do more than create a product or service that solves a problem for someone.

It is also important to establish yourself as an authority in the niches you choose. It means building a name online and offline.

Helping others solve problems is the best way to establish a reputation. You need to think about how you can add value to your community.

Once you have answered this question, you will be able immediately to determine which areas are best suited for you. There are countless ways to earn money online, and even though there are plenty of opportunities, they're often very competitive.

You will see two main side hustles if you pay attention. One involves selling products directly to customers and the other is offering consulting services.

There are pros and cons to each approach. Selling products or services gives you instant satisfaction because you get paid immediately after you have shipped your product.

The flip side is that you won't be able achieve the level you desire without building relationships and trust with potential clients. In addition, the competition for these kinds of gigs is fierce.

Consulting allows you to grow and manage your business without the need to ship products or provide services. But it takes longer to establish yourself as an expert in your field.

If you want to succeed at any of the options, you have to learn how identify the right clients. This can take some trial and error. But it will pay off big in the long term.

Statistics

- According to a June 2022 NerdWallet survey conducted online by The Harris Poll. (nerdwallet.com)

- As mortgage rates dip below 7%, ‘millennials should jump at a 6% mortgage like bears grabbing for honey' New homeowners and renters bear the brunt of October inflation — they're cutting back on eating out, entertainment and vacations to beat rising costs (marketwatch.com)

- According to the company's website, people often earn $25 to $45 daily. (nerdwallet.com)

- Mortgage rates hit 7.08%, Freddie Mac says Most Popular (marketwatch.com)

- 4 in 5 Americans (80%) say they put off financial decisions, and 35% of those delaying those decisions say it's because they feel overwhelmed at the thought of them. (nerdwallet.com)

External Links

How To

How to make money online

How to make money online today differs greatly from how people made money 10 years ago. You have to change the way you invest your money. While there are many methods to generate passive income, most require significant upfront investment. Some methods are simpler than others. But if you want to make real money online, there are some things you should consider before investing your hard-earned cash into anything.

-

Find out which type of investor you are. You might be attracted to PTC sites (Pay per Click), which pay you for clicking ads. On the other hand, if you're more interested in long-term earning potential, then you might prefer to look at affiliate marketing opportunities.

-

Do your research. Research is essential before you make any commitment to any program. Review, testimonials and past performance records are all good places to start. You don’t want to spend your time and energy on something that doesn’t work.

-

Start small. Do not rush to tackle a huge project. Instead, you should start by building something small. This will let you gain experience and help you determine if this type of business suits you. You can expand your efforts to larger projects once you feel confident.

-

Get started now! It's never too soon to start making online money. Even if you have been working full-time for years you still have time to build a strong portfolio of niche websites. You just need a good idea, and some determination. Get started today and get involved!